UAE Government Domestic Treasury T-Sukuk Momentum Continues in 2025 with Successful Auction on 24 June Raising an Aggregate AED1.1bn (USD300mn) with a Subscription Orderbook of AED6.21bn (USD1.69bn)

The dirham-denominated Islamic Treasury Sukuk (T-Sukuk) first introduced by the UAE Ministry of Finance (MoF) in collaboration with the Central Bank of the UAE (CBUAE) in 2023, continued to gain traction in June 2025 as sovereign domestic Sukuk issuances to regulate liquidity management and reserve requirements of Islamic financial institutions and the Islamic banking units of conventional banks authorised in the emirate.

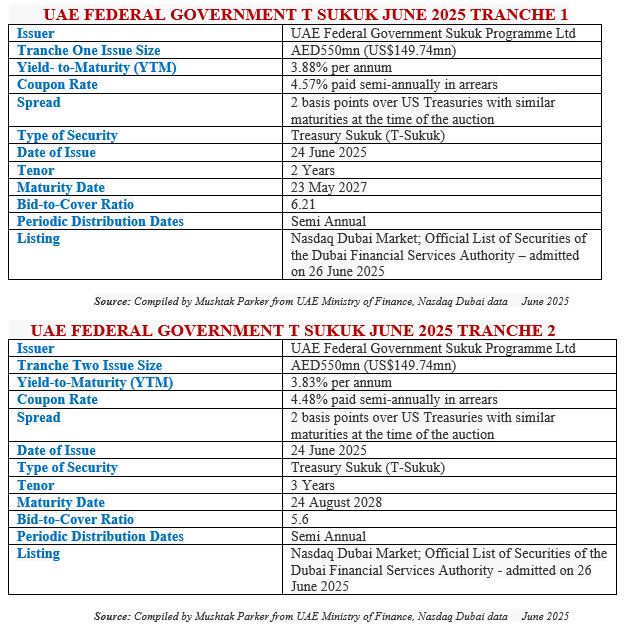

The latest such transaction was on 24 June 2025 by the MoF, in its capacity as the issuer and in collaboration with the CBUAE as the issuing and payment agent, successfully completing an auction of UAE Dirham-denominated Islamic Treasury Sukuk (T-Sukuk) amounting to AED1.1bn (USD299.48mn) in two tranches of AED550mn (US$149.74mn) each.

The Islamic T-Sukuk issuance programme, says the CBUAE will contribute to building the UAE dirham denominated yield curve, providing safe investment alternatives for investors, strengthening the local debt capital market, developing the investment environment, as well as supporting sustainable economic growth. offering secure investment instruments for a wide range of investors. It also reinforces the local debt capital market, contributes to the development of the broader investment landscape, and supports the UAE’s long-term economic sustainability and growth objectives

As such it is aimed more at ordinary UAE investors as opposed to big institutional ones and guaranteed by the UAE Government and therefore insulated from the uncertainties in the global economy and financial markets because of Trump administration tariffs and trade disruptions.

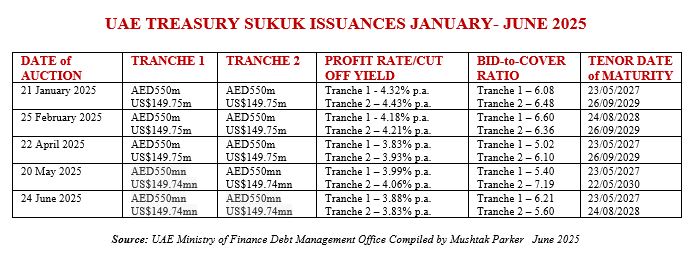

The T-Sukuk auction on 24 June 2025 which are part of the Islamic T-Sukuk issuance programme for First Half 2025 attracted robust demand from eight primary dealers across both tranches – re-opening of the 23 May 2027 and 24 August 2028 tranches. The total bids received reached AED6.21bn (USD1.69bn), reflecting an oversubscription rate of 6.2 times, underscoring the strong confidence of investors in the UAE’s creditworthiness and Islamic finance framework. The bid-to-cover ratio for the 2-year May 2027 tranche was 6.21, and for the 3-year August 2028 tranche 5.6.

The auction results highlighted competitive, market-driven pricing with a Yield to Maturity (YTM) of 3.88% for the May 2027 tranche and 3.83% for the August 2028 tranche. These yields represent a tight spread of 2 basis points for both tranches, respectively, above comparable US Treasuries at the time of issuance. This translates into a coupon rate of 4.57% per annum paid semi-annually in arrears for the May 2027 tranche, and a Coupon Rate of 4.48% per annum paid semi-annually in arrears for the August 2028 tranche.

The MoF, according to the issuance calendar for 2025, plans to have another 7 two-tranche auctions of T-Sukuk in 2025 with the aim of issuing an aggregate AED9,900mn (USD2,695.66mn) in the process.

The next auction will be on the 23 September 2025. As of 24 June 2025, according to the Ministry, there were AED21,351.1mn (USD5,813.30mn) of T-Sukuk outstanding. The June auction comprised two tranches each of AED550mn (US$149.74mn), thus totalling AED1.1bn (USD299.48mn) per transaction.

In the first six months of 2025, the UAE Treasury has raised an aggregate AED5.5bn (USD1.50bn) in five auctions. The Tranche 1 Securities, according to the UAE Ministry of Finance, will be consolidated with AED 4.40bn (USD1.20bn) Treasury Sukuk due in 2027. The Tranche 2 Securities similarly will be consolidated with AED2.75bn (USD750mn) Treasury Sukuk due in 2028.

The T-Sukuk structure is based on Murabaha/Ijara assets with the asset pool comprising 54% Ijara assets and 46% Murabaha receivables. The UAE Federal Government Sukuk Programme Ltd is the Trustee and Lessor acting on behalf of the Government of the United Arab Emirates, acting through the Ministry of Finance – the Obligor, Seller, Lessee and Servicing Agent to the transaction. The Sukuk certificates are listed and traded on the Nasdaq Dubai Main Market and on the Official List of Securities of the Dubai Financial Services Authority (DFSA). All the T Sukuk offerings are issued under the unlimited UAE Treasury Sukuk Programme.

The Sukuk are issued via eight primary dealers, with the UAE Central Bank acting as the issuing and payment agent. To facilitate the smooth implementation of the T-Sukuk initiative, the MoF published a robust Primary Dealers code and onboarded eight banks namely Abu Dhabi Islamic Bank, Dubai Islamic Bank, Abu Dhabi Commercial Bank, Emirates NBD, First Abu Dhabi Bank, HSBC, Mashreq and Standard Chartered as Primary Dealers to participate in the T-Sukuk primary market auction and to actively develop the secondary market.

According to UAE Minister of State for Financial Affairs, Mohamed Bin Hadi Al Hussaini, the introduction of the T Sukuk “reaffirmed the UAE’s keenness to strengthen the Islamic economy and boosts the size of financial alternatives for investors which contributes to developing the UAE’s investment environment.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we are pleased that the Group is involved in the T-Sukuk programme, with underlying Murabaha transactions being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.