NDMC Sustains Saudi Riyal Sovereign Sukuk Issuance in May 2025 Ahead of the Eid-ul-Adha Break with a 4-Tranche Offering Totalling SAR4.1bn (USD1.1bn) and a Standalone SAR60.3bn (USD16.08bn) Sukuk Offering Bringing the Aggregate Issuance to a Staggering SAR64.4bn (USD17.18bn)

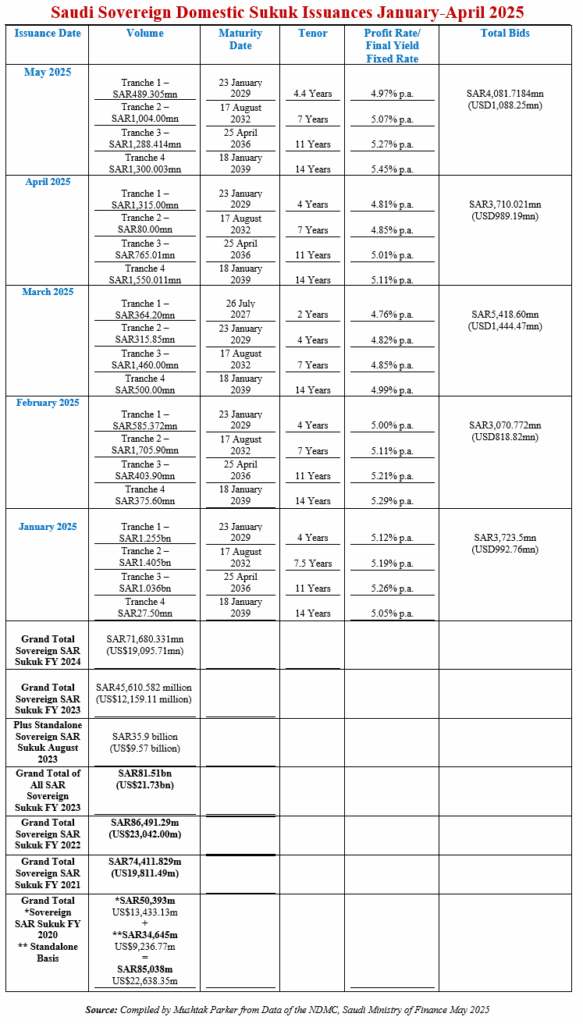

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) continued its monthly Sukuk issuance momentum in May 2025 ahead of the Eid-ul-Adha festivities marking the end of the Hajj pilgrimage, with a four-tranche aggregate issuance of SAR4,081.7184mn (USD1,088.25mn) on 20 May. This compared to the April 2025 Sukuk 4-tranche Sukuk offering which raised SAR3,710.021mn (USD989.19mn).

The Kingdom is ahead in tapping the domestic sovereign Sukuk market for manifold reasons including the presence of an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The uncertainties and unpredictability relating to the tariff announcements by the Trump administration and the potential global trade disruption, and the concomitant fall in oil and gas prices with its knock-on effects of national budgets, is already impacting on the global economy, on national budgets and the cost of living in all economies, which will inevitably lead to higher borrowing and debt accumulation.

Fitch Ratings has already projected the Saudi Debt Capital Market (DCM) to exceed USD500bn outstanding in 2025. By end of Q1 2025, the DCM had already reached USD465.8bn outstanding, up 16% y-o-y, with a Sukuk majority of 60.4%, split mostly between US dollars (52.4%) and Saudi riyal issues (45.3%).

In a strange way, this development augurs well for the continuation of the NDMC’s Sukuk issuance strategy – not only its regular SAR-denominated sovereign Sukuk issuance under its published calendar, but also one-off transactions, usually associated with early redemptions of existing debt. These pertain to local currency Sukuk issuances and do not include the NDMC’s forays into the international Sukuk market and syndicated Commodity Murabaha markets.

The latest such development was on 25 May 2025 when the NDMC announced the completion of an early redemption of a portion of the Issuer’s outstanding Sukuk maturing in 2025, 2026, 2027, 2028, 2029 with a total value about SAR60.4bn (USD16.10bn), in addition to an issuance of new Sukuk with a total value around SAR60.3bn (USD16.08bn).

This means that in the month of May 2025 alone, the NDMC raised a staggering SAR64.4bn (USD17.18bn) in SAR-denominated Sukuk comprising the regular monthly issuance totalling SAR4,081.7184mn (USD1,088.25mn) in May 2025, plus the standalone issuance of SAR60.3bn (USD16.08bn). This means that the total funds raised by the NDMC through sovereign domestic Sukuk in the first five months of 2025 amounted to SAR77.54bn (USD20.69bn).

No other market in which Islamic banking and Islamic debt capital market are of systemic importance can match the Saudi issuance activity and ambitions.

This initiative, says the NDMC, is a continuation of it’s efforts to strengthen the domestic market and enables it to exercise its role in managing the government debt obligations and future maturities. This will also align NDMC’s effort with other initiatives to enhance/optimize the public fiscus in the medium and long term.

The NDMC divided the new Sukuk issuances into five tranches with a total value around SAR 60.3bn. The first tranche amount is about SAR21.5bn maturing in 2032, the second tranche amount is around SAR1.8bn maturing in 2035, the third tranche amount is approximately SAR14.2bn maturing in 2036, the fourth tranche amount around SAR5.9bn maturing in 2039, and the fifth tranche amount about SAR16.9bn maturing in 2040.

The Ministry of Finance (the Issuer) and NDMC mandated HSBC Saudi Arabia, SNB Capital, Al Rajhi Capital, AlJazira Capital and Alinma Investment as Joint Lead Managers to lead the transaction.

The Saudi sovereign domestic Sukuk issuance of an aggregate SAR4,081.7184mn (USD1,088.25mn) on 20 May comprised:

i) A 4.4 -Year Tranche of 3054mn (USD130.46mn) priced at a yield of 4.97% p.a. maturing on 23 January 2029.

ii) A 7 -Year Tranche of SAR1,004.00mn (USD267.68mn) priced at a yield of 5.07% p.a. maturing on 17 August 2032.

iii) A 11-Year Tranche of SAR1,288.414mn (USD343.51mn) priced at a yield of 5.27% p.a. maturing on 25 April 2036.

iv) A 14.4-Year Tranche of SAR1,300.003mn (USD346.60mn) priced at a yield of 5.45% p.a. maturing on 18 January 2039.

Total bids for the 4-tranche transaction on 20 May 2025 amounted to SAR4,081.7184mn (USD1,088.25mn), the aggregate allocated amount.

The Kingdom has raised an aggregate SAR17,226.0614mn (USD4.61bn) for the first five months of 2025 through Saudi riyal-denominated sovereign Sukuk issuances under its dedicated SAR Sukuk Issuance Programme Calendar.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

These issuances, confirmed the NDMC, will continue in accordance with the approved 2025 Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally.

This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while considering market movements and the government debt portfolio risk management.

The NDMC says it is committed to ensuring the Kingdom’s sustainable access to various debt markets to issue sovereign debt instruments at fair prices while maintaining prudent risk levels. To achieve this objective, it will continue to diversify financing channels throughout 2025. This diversification will include expanding financing through export credit agencies (ECAs), financing infrastructure projects, and exploring tapping into new markets in new currencies. These initiatives aim to expand the investor base and enhance the Kingdom’s access to global capital markets.

In January 2025, the Saudi Ministry of Investment’s updated investment rules also came into effect, which according to the NDMC will make it easier for foreign investors to invest in the Kingdom to attract more international investment by streamlining the process and creating a more investor-friendly environment. The ministry highlighted that the updated regulations would eliminate the need for many licenses and prior approvals, as well as significantly reduce paperwork and bureaucratic hurdles.

In this respect, the NDMC continues to work on attracting new capital, and more international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. Already, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank have signed up as new primary dealers in the government’s local debt instruments. They join five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.