SNB Returns to the Market with Second AT1 Sukuk Offering in Six Months with a SAR1.73bn (USD461.26mn) Additional Tier 1 Capital Sukuk Wakala Offering in May 2025

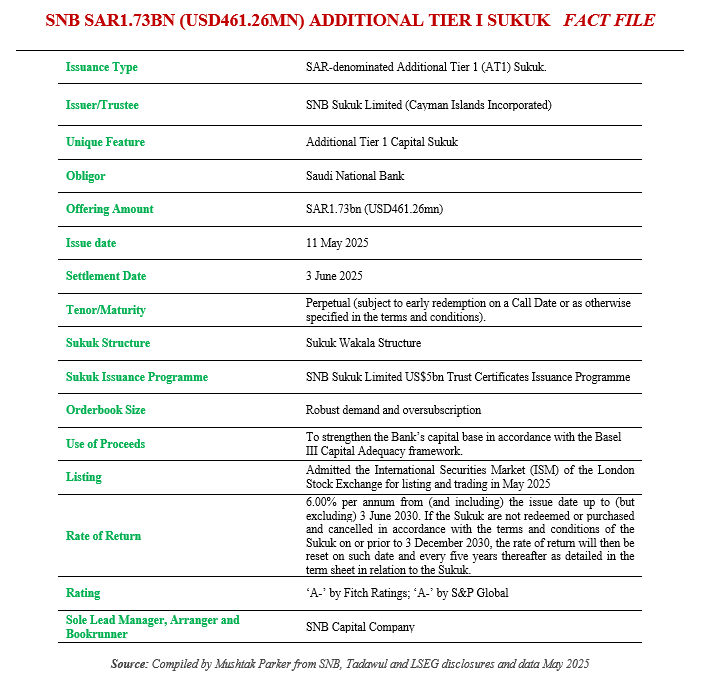

The Saudi National Bank (SNB) (formerly National Commercial Bank (NCB)), the largest bank in the Kingdom in terms of assets, returned to the public debt market in 2025 with the successful completion of a SAR-denominated Additional Tier 1 (AT1) Sukuk raising SAR1.73bn (USD461.26 mn) in the process.

It seems that AT1 Sukuk are not the exclusive domain of US dollar issuances but also increasingly in local currency of which the Saudi riyal is by far the dominant currency.

In fact, in 2024 SNB issued two Sukuk – a 5-year benchmark Reg S Sustainability senior unsecured US$850 million Sukuk Wakala in February and the SAR6bn (USD1.6bn) AT1 Sukuk Wakala in November.

The Bank mandated SNB Capital Company as Sole Lead Manager, Bookrunner, and Lead Arranger to the transaction. SNB Capital started marketing the Sukuk by way of an offer to eligible investors in the Kingdom of Saudi Arabia, on 11 May 2025.

The Sukuk certificates were issued by SNB Sukuk Limited (Cayman Islands Incorporated) on behalf of the Obligor Saudi National Bank under SNB Sukuk Limited’s US$5bn Trust Certificates Issuance Programme.

In a disclosure to Tadawul (the Saudi Exchange), SNB said that the pricing for the AT1 SAR6bn Sukuk was set at 6.00% per annum from (and including) the issue date up to (but excluding) 3 June 2030.

“If the Sukuk are not redeemed or purchased and cancelled in accordance with the terms and conditions of the Sukuk on or prior to 3 December 2030, the rate of return will then be reset on such date and every five years thereafter as detailed in the term sheet in relation to the Sukuk,” it added.

The November 2024 AT1 Sukuk was similarly priced at a rate of return of 6% per annum.

This latest AT1 issuance like the previous one has no tenor because it is a Perpetual transaction (subject to early redemption on a Call Date or as otherwise specified in the terms and conditions).

The proceeds from the issuance will be used to strengthen the Bank’s capital base in accordance with the Basel III Capital Adequacy framework.

Application has been made to list and trade the Sukuk certificates, rated ‘A-’ by Fitch Ratings and S&P Global – both with a Stable Outlook, on the International Securities Market of the London Stock Exchange.