Seventh Offering of Federal Government of Nigeria ₦300bn Sukuk Ijarah Oversubscribed by 735% as Road Infrastructure Linked Sukuk Comes of Age

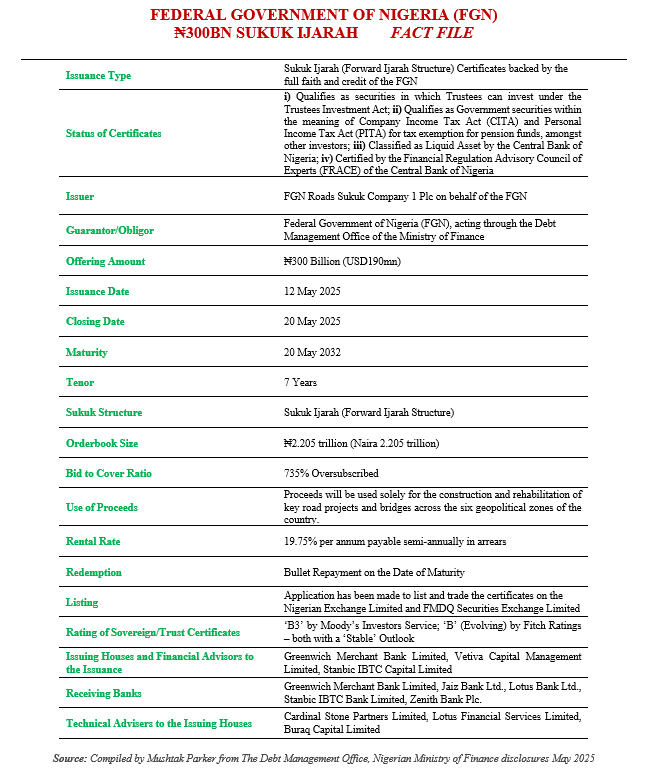

At its seventh attempt, is the Federal Government of Nigeria (FGN) sovereign Naira-denominated Sukuk issuance finally coming of age? Buoyed by a sovereign ratings upgrade in April 2025 by both Moody’s Investor Services and Fitch Ratings to ‘B3’ and ‘B’ – both with a stable outlook – the Debt Management Office (DMO) of the Nigerian Finance Ministry, acting on behalf of the FGN, went to the market to raise ₦300bn (USD190mn) through a Sukuk Ijarah offering on 12 May 2025.

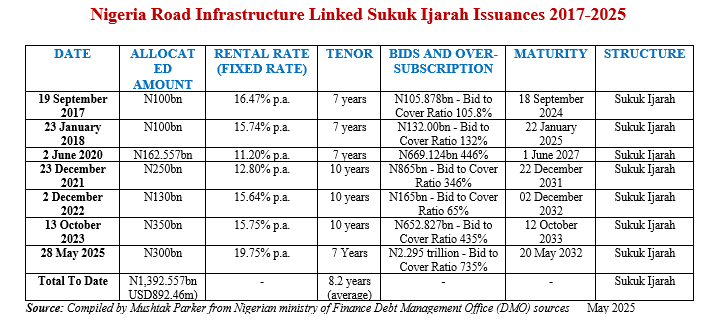

This is the seventh offering in the FGN Series of Sukuk which started in September 2017 with an inaugural issuance of ₦100bn. Since then, the DMO, under the outstanding and perspicacious leadership of Director General Patience Oniha, has not looked back and facilitated the steady proliferation of sovereign domestic Sukuk issuances on an almost annual basis. That sovereign Sukuk issuance is now firmly entrenched in the public fund-raising playbook of the DMO – subject to the wishes of the Federal Government and the Ministry of Finance – is not in doubt. The DMO is now steadily building up a yield curve for Naira-denominated Sukuk and in the process diversifying its public fund-raising strategy and investor base, sections of which hitherto would have been untapped, and of course advancing the cause of financial inclusion.

Due to the success of the previous six issuances and some creative people-centred marketing, in which the DMO has pioneered a unique democratisation of access to the capital market by reserving a portion of the subscription to the Sukuk offerings to retail and ultra-retail investors, it is not surprising that the FGN Sukuk is proving to be an attractive asset class for Nigerians to invest in irrespective of their faith, creed or class. The differentiated Sukuk offering subscription forms for qualified institutional investors and retail unqualified investors are implicit. It is not unusual for poster boards to stress that the construction and rehabilitation of a particular section of a designated highway was funded by the proceeds of a Sukuk offering. These span key road projects and bridges across the six geopolitical zones of the country.

What was remarkable of this seventh Sukuk issuance is that it recorded an unprecedented subscription level of over ₦2.205 trillion (USD1.41bn), representing a bid-to-cover ratio of 735.00. “This is clear evidence of the huge investor-appetite for the ethical instrument introduced by the DMO in 2017 as an innovative strategy to expand the nation’s investor-base and provide opportunities for all Nigerians to participate in the activities of the capital market. An analysis of the subscriptions showed that the subscribers cut across various segments of the public: retail, non-interest banks and financial institutions, banks, pension fund administrators, asset/fund managers and others,” stressed the DMO.

Like the previous series, funds realized from the Sukuk issue will be used by the FGN to construct new roads and rehabilitate existing ones, as well as build bridges in the six geopolitical zones of the country and the Federal Capital Territory.

To date, the DMO has raised ₦1,392.557bn (USD892.46mn) through seven Sukuk issuances. “The raising of funds through Sukuk issuances to finance infrastructure projects,” stressed the DMO, “aligns with our President’s Renewed Hope Agenda of which infrastructure development is a key pillar. The DMO remains committed to providing safe and liquid investment products to the public and supporting the FGN’s development plans.”

This latest transaction involved a wide range of Nigerian financial institutions and was jointly lead managed by Greenwich Merchant Bank Limited; Stanbic IBTC Capital Limited, a member of South Africa’s Standard Bank Group; and Vetiva Capital Management Limited. They together with Buraq Capital Limited also acted as issuing houses and adviser to the transaction. Stanbic IBTC Bank Plc, Jaiz Bank Plc, Lotus Bank Ltd, Zenith Bank Plc and Greenwich Merchant Bank Ltd acted as receiving banks.

As a public debt instrument, the FGN ₦-denominated Sukuk is now an established instrument in the Nigerian capital market, which is attracting an ever-diversified investor cohort ranging from institutional to ultra retail investors. As an instruments and strategy, the Nigerian Sukuk playbook has a lot going for itself:

- It has shown sustainability of issuance – this is the seventh issue in 8 years, which indicates regularity of mark to market transactions.

- It has the guarantee of the FGN thus giving extra investment security comfort to investors, who are increasingly also non-traditional ones.

- It effectively is a “Made in Nigeria” transaction involving locally incorporated entities and expertise along the structuring and financial engineering chain. These include local Issuing Houses and Financial Advisors to the Issuance; Technical Advisers to the Issuing Houses; Receiving Banks; and Placement Agents.

- The Sukuk certificates are listed and traded on the Nigerian Exchange Limited and FMDQ Securities Exchange Limited, potentially freeing up further liquidity for the projects specified under use of proceeds provisions.

- The strategy of wider public awareness campaigns to invest in the Sukuk offering has handsomely paid off, given the 735% oversubscription. The DMO in fact now organises regular Investors’ Meeting for the Sovereign Sukuk Issuance in Abuja. The meeting for this latest transaction was held on 14 May 2025.

- The DMO’s Sukuk issuance strategy is unique in that it is entirely focused on financing the rehabilitation and reconstruction of key road projects across the six geopolitical zones and the Federal Capital Territory. This strategy is based on the compartmentalisation of road infrastructure-linked fund-raising through Sukuk which includes key oversight functions of independent audit of the monies raised in terms of contract allocations, procurements and timely payments to contractors; and treating the transaction as a standalone one so that there is no co-mingling of funds through unauthorised drawdowns. It appears capable of evolution as a model for other countries – both in developed and developing economies.

The DMO has in the past maintained that it “will work to sustain the laudable achievements recorded so far in the use of Sukuk Issue proceeds for the construction and rehabilitation of Nigerian roads, and thereby, continue to enhance ease of commuting and doing business, safety on our roads, job creation, economic growth, and the prosperity of our nation.”

According to Patience Oniha, Director of General of the DMO, the FGN Sukuk embodies two key sustainability features – infrastructure and financial inclusion. “We consider Sukuk to be one of the useful and accepted products for raising funds,” she explained. “The proceeds from the issuance will be used solely for the construction and rehabilitation of 44 arterial roads across the six geopolitical zones of the country. Issuing further Sukuk, will depend on eligible projects in the 2023 Appropriation Act.”

The development impact of Sukuk is clearly visible – improved road infrastructure within and outside Nigerian cities, timely completion of designated projects and the multiplier effects associated with construction of capital projects such as roads.

This, says the DMO, has brought reprieve to road users, improved travel times between major commercial cities, linked borrowing and government expenditure to specific critical projects, helped increase the flow of cargo and passenger traffic across major cities, and improved infrastructure delivery across the country. The impact of the sovereign Sukuk on road infrastructure in terms of job creation, travel time, safety and movement of goods have made the Sukuk a beneficial financial instrument for financing economic growth and development

The two challenges for the Nigerian Sukuk market are issuing a debut Sukuk in the international market, if only to test international investor appetite and to diversify the sovereign’s foreign investor base; and how to upscale Sukuk issuances to crowd in private sector involvement and to get more Nigerian states, agencies and corporates to raise funds through Sukuk offerings thus adding depth and variety to the local capital market.