Alinma Bank is the Fourth Saudi Islamic Bank in May 2025 to Issue Additional Tier 1 Capital Perpetual Sustainable Sukuk Mudaraba, with a USD500mn Issuance

Alinma Bank, one of the leading ‘new’ dedicated Islamic banks in Saudi Arabia based on “adopting a digital-first banking model”, completes the quartet of local Saudi banks which have tapped the international US dollar market in May 2025 with an Additional Tier 1 (AT1) Capital Perpetual Callable 5.5 Years Sustainable Sukuk Mudaraba issuance.

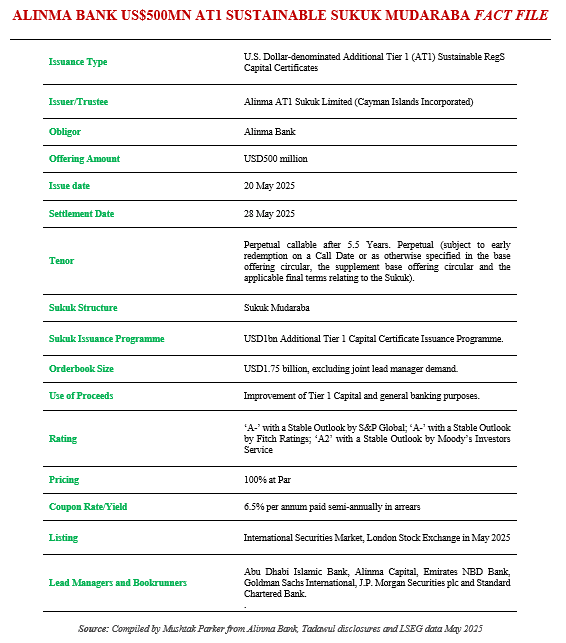

The Bank returned to the international Sukuk market in May 2025 with the aim of boosting its AT1 capital with a benchmark USD500mn AT1 Capital Sukuk Mudaraba.

The transaction was launched on 20 May 2025 and distributed by way of private placement to eligible investors in the Kingdom of Saudi Arabia and to international investors.

It is just over a year since Alinma Bank issued a similar AT1 Capital USD1bn Sukuk Mudaraba in February 2024. AT1 Sukuk issuance seems to be the preferred instrument for Gulf Cooperation Council (GCC) Islamic financial institutions in support of Basel III capital and insolvency requirements.

The Sukuk certificates of the latest US dollar transaction were issued by Alinma AT1 Sukuk Limited (Cayman Islands Incorporated) on behalf of the Obligor, Alinma Bank. The certificates were issued under the Bank’s USD1bn Additional Tier 1 Capital Certificate Issuance Programme, established in May 2025 and arranged by Alinma Capital Company and J.P. Morgan, who together with Abu Dhabi Islamic Bank, Emirates NBD Capital, Goldman Sachs International, and Standard Chartered Bank also acted as dealers to the Programme.

The Bank mandated Abu Dhabi Islamic Bank, Alinma Capital, Emirates NBD Bank, Goldman Sachs International, J.P. Morgan Securities plc and Standard Chartered Bank to act as Joint Lead Managers and bookrunners on 20 May 2025 to arrange a series of investor calls with accounts in the Kingdom and internationally in relation to the offer with the intention to issue by way of a private placement.

The result was a Perpetual non-callable 5.5 Years Benchmark USD5000mn RegS Senior Unsecured Sustainable AT1 Sukuk Mudaraba issuance. The initial price thoughts were around a profit rate of 7.0% per annum. The order book reached over USD1.75bn – over 3x oversubscribed – which allowed the issuer to tighten the price to a final coupon rate of 6.5% p.a. paid semi-annually in arrears.

The settlement of the Sukuk issuance was on 20 May 2025. According to Alinma Bank, the proceeds from the issuance will be used to strengthen the Bank’s Tier 1 Capital and for general banking purposes tied in to the Bank’s sustainable finance framework.

Application has been made to list and trade the Sukuk certificates, rated ‘A2’ Moody’s Investors Services and ‘A-’ by Fitch Ratings and S&P Global – all with a Stable Outlook, on the International Securities Market of the London Stock Exchange.