Abu Dhabi’s Mamoura Diversified Global Holding (Mubadala) Issues Third Sukuk in a Year with a USD1bn Sukuk Wakala Transaction in May 2025 as SWFs Consolidate Their Activities in the Local and International Markets

Is there a method to the issuance frenzy of OIC-based sovereign wealth funds (SWFs)? Lest we get carried away, of the 31 SWFs in the Organisation of Islamic Cooperation (OIC), most of them have never issued a Sukuk or probably will never contemplate doing so, at least in the short-to-medium term.

But when the Big Hitters such as the Public Investment Fund (PIF) in Saudi Arabia and Mamoura Diversified Global Holding, a subsidiary of Mubadala Investment Company, are leading from the front with regular issuances over the last two years, aided and abetted by the occasional issuances by Khazanah Nasional Berhad (Malaysia), the Investment Corporation of Dubai, Mumtalakat Holding (Bahrain) and new entrants such as the Türkiye Wealth Fund, then both issuers and investors sit up and take note.

Khazanah was the first SWF to issue Sukuk, in 2011 with a RM500 mn (US$107.58 mn) offering. In fact, it has pioneered several types of Sukuk (including equity exchangeable Sukuk linked to telecoms and bundles of mobile telephony airtime, shopping mall assets in China, and education-linked social Sukuk), but it has long lost its first mover advantage.

The Sukuk mood music is blaring from the desert sands of the Arabian Peninsula partly to finance the mega projects driven by Saudi Arabia’s Neom City Initiative, the economic diversification strategy of the Gulf Cooperation Council (GCC) countries and for budgetary support purposes and expansion of key infrastructure in Türkiye and elsewhere.

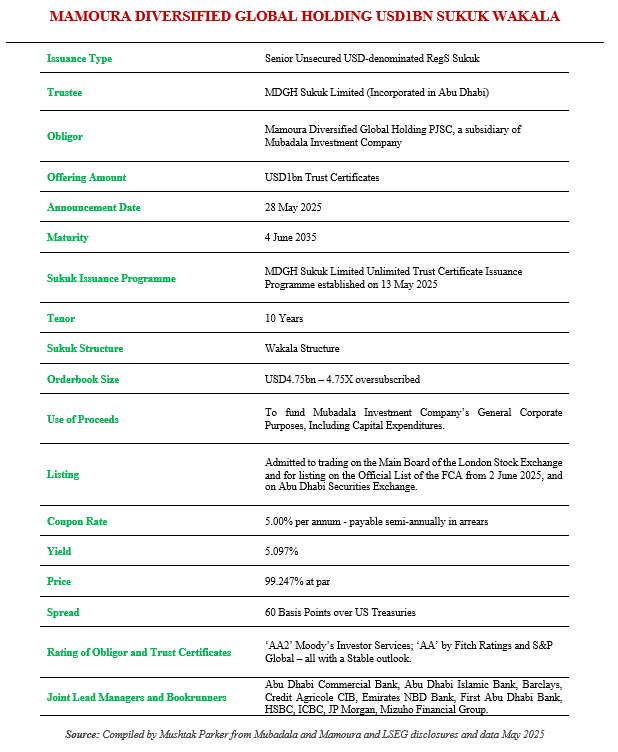

So, when Mamoura Diversified Global Holding in Abu Dhabi issued its third Sukuk on 28 May 2025 – its third Sukuk offering in a year – then issuance traction is potentially firmly rooted. Mamoura issued its debut US Dollar Sukuk in April 2024 – a 10-year USD1bn Sukuk Wakala, followed by a 5 year AED1bn (USD272.3mn) Sukuk in October 2024, and now this latest transaction. The seemingly insatiable demand for funding is guided by the UAE government’s drive for the economic diversification of Abu Dhabi. Mubadala, owned by the Government of Abu Dhabi, was established on a strategy built on the management of long-term, capital-intensive investments that deliver strong financial returns and tangible social benefits for the Emirate.

Mubadala brings together and manages a multibillion-dollar portfolio of local, regional, and international investments. At end April 2025, Mudabala’s total assets under management (AUM) reached AED1,212 bn (USD330bn), and its total investment portfolio reached AED119 bn (USD$32bn).

|

Through this strategy Mubadala partners with leading global entities to operate businesses across a wide range of industry sectors including aerospace, energy and industry, healthcare, information communications and technology, infrastructure and real estate, aimed at expanding the economic base of Abu Dhabi and the UAE and contribute to the growth and diversification of its economy. Mamoura mandated a consortium of banks led by Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Barclays, Credit Agricole CIB, Emirates NBD Bank, First Abu Dhabi Bank, HSBC, ICBC, JP Morgan, Mizuho Financial Group to act as joint lead managers and bookrunners , and to arrange a series of investor meetings starting on 28 May 2025 in London, Europe, the Gulf Cooperation Council (GCC) region, the MENAT region, Asia and with Offshore US accounts. The Sukuk certificates were issued through MDGH Sukuk Limited, a subsidiary of Mamoura Diversified Global Holding, the Obligor, under its unlimited Trust Certificate Issuance Programme, established on 13 May 2025 and arranged by ADCB, Emirates NBD Capital, ADIB, First Abu Dhabi Bank and Standard Chartered Bank, who together with HSBC also acted as dealers. MDGH Sukuk Limited acted as both issuer of the Sukuk certificates and as Trustee. The transaction was well received by the market with robust demand for the certificates and the order book reaching US$4.75bn, or 4.75 times over-subscribed. Mubadala had set the initial price guidance for the transaction at around 95 basis points (bps) over US Treasuries. Due to the strong demand, the price tightened and eventually the transaction was closed at a spread of 60bps over US Treasuries. This compared with the yield of 90 bps over US Treasuries for the similar 10-Year USD1bn Sukuk issued in April 2024 at a fixed profit rate of 4.959% per annum. The proceeds from the issuance will be used to fund Mubadala Investment Company’s general corporate purposes, including capital expenditures. The Sukuk certificates were admitted for listing and trading on the Main Board of the London Stock Exchange and for listing on the Official List of the FCA from 2 June 2025, and on the Abu Dhabi Securities Exchange. |