DP World Returns to International Market in April 2025 with a 10-year USD1.5bn Sukuk Wakala to Fund its Global Container Ports and Transport Logistics Expansion Activities

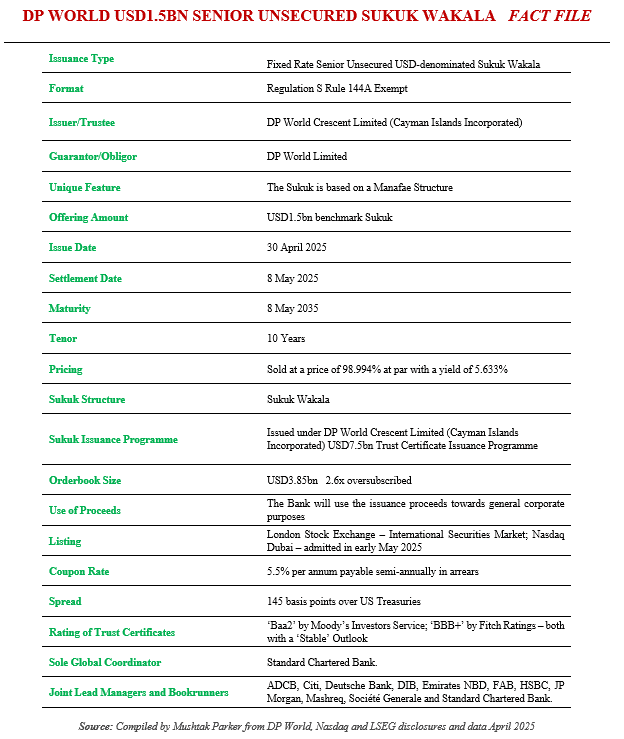

Dubai-based DP World, one of the largest logistics, marine and container terminal operators in the world, which is owned by the Government of Dubai, returned to the international Sukuk market after an absence of almost two years, with a successful issuance of its latest offering, a USD1.5bn Senior Unsecured RegS Sukuk Wakala on 30 April 2025.

The Sukuk certificates, which have a tenor of 10 years and mature on 8 May 2025, were issued by DP World Crescent Limited (Cayman Islands Incorporated) on behalf of the Obligor, DP World limited, under its USD7.5bn Trust Certificate Issuance Programme.

DP World Crescent Limited had earlier mandated Abu Dhabi Commercial Bank (ADCB), Citi, Deutsche Bank, Dubai Islamic Bank (DIB), Emirates NBD, First Abu Dhabi Bank (FAB), HSBC, JP Morgan, Mashreq, Societe Generale and Standard Chartered Bank to act Joint Lead Managers and Bookrunners of the transaction, and to arrange a series of investor calls and roadshows with accounts in the UK, EU, the MENA region, Asia and Offshore US for a benchmark US dollar-denominated Sukuk Wakala offering. The result was a USD1.5bn offering based on the Manafae Sukuk structure.

The initial price thoughts (IPTs) on 29 April 2025 for DP World’s 10-year 144A Reg S US dollar benchmark Sukuk were in the area of +175 basis points (bps) over US Treasuries. Due to the high demand for the certificates, with the orderbook 2.6 times oversubscribed and exceeding USD3.85bn, the spread tightened to settle at a final 145 bps + US Treasuries.

The settlement date for the issuance will be 8 May 2025. The Sukuk certificates were sold at a price of 98.994% at par with a yield of 5.633%. This translates into a coupon rate of 5.5% per annum payable semi-annually in arrears.

According to DP World the proceeds from the issuance will be used to fund general corporate purposes including expansion of activities at various locations and DP World operated ports around the world. The latest such project announced by DP World on 30 April 2025, is the USD165mn expansion of DP World’s container terminal at the Port of Maputo in Mozambique, which is a member state of the OIC and the Islamic Development Bank (IsdB) Group and on which work officially started on 1 May 2025.

The expansion of the container terminal at the Port of Maputo, stressed DP World, is part of a long-term strategy to meet global trade demands, create thousands of new jobs and contribute to Mozambique’s economic growth.

The project, says DP World, will significantly enhance capabilities of the port, positioning Maputo as a trade and logistics hub for Southern Africa and opening a gateway for larger container ships.

DP World also recently joined forces with Mota-Engil, a renowned ports and logistics contractor, to build the Banana Port project in the Democratic Republic of Congo (DCR), which according to Sultan Ahmed bin Sulayem, Group Chairman and CEO of DP World, is “set to transform the country’s trade landscape by providing state-of-the-art infrastructure,

reducing cost for businesses, and reinforcing the DRC’s economic independence.

The Sukuk certificates are rated in line with DP World’s ‘Baa2’ corporate rating by Moody’s Investors Service; and ‘BBB+’ by Fitch Ratings – both with a ‘Stable’ Outlook. The certificates will be listed on the International Securities Market of the London Stock Exchange and on Nasdaq Dubai in early May 2025. DP World Crescent Limited has USD5.5bn in Sukuk issued, with maturity beginning in 2028.

Prior to this latest Sukuk transaction, DP World last accessed the Sukuk market in October 2023 with an USD1.5bn Green Sustainability Sukuk to support its global decarbonisation efforts. The Sukuk was priced at a spread of 119.8 bps over US treasuries with a 5.5% coupon rate, and according to DP World it achieved one of the tightest spreads for a BBB+ rated corporate globally.