Saudi Sovereign Wealth Fund PIF Consolidates with Third Consecutive Sukuk Issuance in Three Years in April 2025 with a USD1.25bn Sukuk Wakala Issue Despite Trade and Tariff Uncertainties in the Global Economy

When you have one of the world’s largest sovereign wealth funds, Saudi Arabia’s Public Investment Fund (PIF), with current assets estimated at USD925bn; one of the world’s largest oil companies ADNOC; one of the world’s largest ports and container logistics operators, DP World; a spate of sovereigns, corporates, financial institutions and ultra retail issuers raising funds in a mere month from the market ranging from USD1.25bn to USD10mn, let alone regular local currency auctions by debt management offices and Treasuries, then the emergence of Sukuk as a growing fund raising instrument of choice is no longer a topic of conjecture or rhetoric. Not surprisingly, Fitch Ratings for instance is projecting global Sukuk outstanding to cross the USD1 trillion mark by the end of this year, from its current USD935bn.

This trend of high impact issuers, some entering the market for the first time, is a welcome trajectory going back more than two years, which has gained a seemingly unstoppable momentum over the last six months, admittedly driven by largely Saudi, UAE and Malaysian issuers where Islamic finance is of systemic importance, but including newer sovereign issuers such as Nigeria, Indonesia, Bahrain, Tȕrkiye, Oman, Qatar, Kuwait, Pakistan and Egypt, and issuers from non-traditional markets including the UK and South Africa.

While Sukuk is now firmly a mainstream instrument for raising funds for supplementing national budgets, providing working capital needs, cash flows for general corporate purposes, supporting capital requirements under Basel III for financial institutions or refinancing existing debt, its globalisation as perhaps the only instrument of note from the Global South is another matter. That Sukuk would become an accepted mainstream instrument utilised by any sovereign debt management office, corporate or social institution, irrespective of nationality, creed or faith is, however, still a work in progress.

The Next Great Leap Forward

Herein lies the next big defining leap forward for Islamic finance, especially debt instruments such as Commodity Murabaha and Sukuk, and social finance structures such as Waqf, to develop a truly global footprint.

It is often said that for any country which has serious ambitions of harbouring an international financial centre or hub, then Islamic finance, Sukuk issuance, listing and trading, and commodity Murabaha must be essential components of the offering mix alongside the conventional finance architecture. Jeddah, Abu Dhabi, Bahrain, The City of London, Hong Kong, Singapore, Kuala Lumpur, Labuan, Dubai, and to a lesser extent Istanbul, Doha, Astana, Abuja and Johannesburg, are also going down this route.

This is not surprising given the impressive proliferation of the Islamic system of financial intermediation and its debt capital market offerings. The fact that the California Pension Fund and other major western and non-traditional accounts are regular investors in Sukuk and participants in Murabaha syndications, and the fact that Saudi Arabia has opened its primary dealership for its local currency Sukuk issuances to the likes of JP Morgan, BNP Paribas, Citigroup, Goldman Sachs and Standard Chartered Bank, is all part of a market liberalisation and globalisation trajectory for the Islamic finance industry in its next few decades of development.

There are of course several gaps still in policy, regulatory, enabling legislation, Shariah governance, market depth and critical mass, product innovation, risk management, digitalisation, gender balance, financial inclusion, effective monitoring and enforcement in the prevailing Islamic finance architecture. The important thing is that it is becoming less fragmented especially as industry bodies such as the IsDB Group, IFSB, AAOIFI, IILM, IIFM and ASAS become more established, mature and urgent in executing their mandates.

In the above context, the entry and role of Saudi Arabia’s Public Investment Fund (PIF) into the Sukuk and Murabaha market is arguably the single most important development in the burgeoning global Islamic finance and capital market. The reason is simple – the huge demand for finance and securing private capital to sustain the Kingdom’s ambitious NEOM Initiative towards achieving the goals of Saudi Vision 2030.

Latest Offering

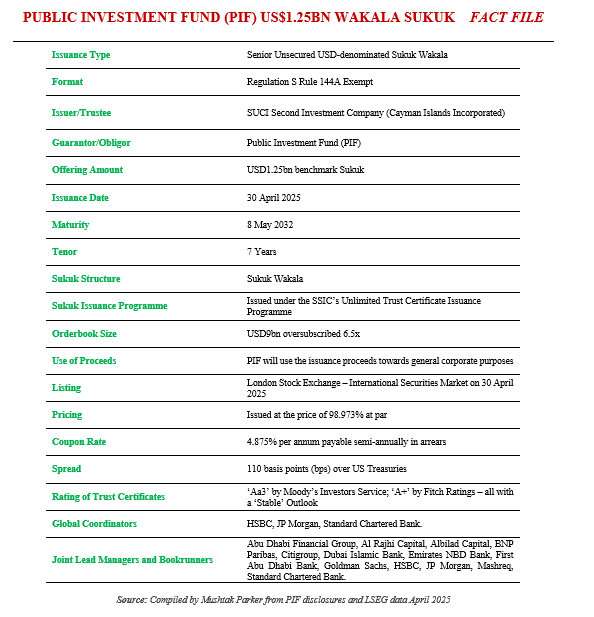

PIF has lost no time in establishing a regular Sukuk issuance curve following on from its maiden USD3.5 billion Sukuk in October 2023, and its USD2bn Sukuk offering in March 2024. At end April 2025, PIF priced its latest foray into the international market with a USD1.25bn Sukuk Wakala offering, bringing the total volume of international Sukuk issued to date to USD6.75bn in three consecutive years.

PIF had mandated Standard Chartered Bank, HSBC and JP Morgan to act as global coordinators and together with Abu Dhabi Financial Group, Al Rajhi Capital, Albilad Capital, BNP Paribas, Citigroup, Dubai Islamic Bank, Emirates NBD Bank, First Abu Dhabi Bank, Goldman Sachs and Mashreq to act as joint lead managers and joint bookrunners on 30 April 2025, and to arrange a series of investor calls and roadshows with accounts in the UK, EU, the MENA region, Asia and Offshore US for a benchmark US dollar-denominated Sukuk Wakala offering.

The result was a 7-year USD1.25bn Sukuk Wakala issued by issuer/trustee SUCI Second Investment Company (Cayman Islands Incorporated) on behalf of the Obligor, PIF under its unlimited Trust Certificate Issuance Programme of September 2024 but updated with a supplemental offering circular dated 30 April 2025.

The Initial Price Thoughts (IPTs) were set at around 145basis points (bps) over US Treasuries. The 7-year Sukuk was more than 6.5 times oversubscribed by accounts from the MENA region, UK, EU, Asia and Offshore US, with the order book exceeding USD9bn. This robust demand allowed PIF to tighten and lower the IPTs to a final spread of 110bps over US Treasuries. Not surprisingly, Ahmed Alrobayan, Head of Public Markets, Global Capital Finance, at PIF, maintained that “the strong investor demand for this new Sukuk offering underscores PIF’s robust credit profile, along with its role as a key driver of Saudi Arabia’s economic transformation. The transaction represents a continuation of our established and diversified financing strategy, which draws strong support from international investors.”

PIF’s long-term capital and fund-raising strategy encompasses capital injections from the Saudi asset transfers from the government through SAMA, the central bank, retained earnings from investments, funds raised through issuance of conventional bonds, Green Bonds, Sukuk, conventional loan facilities, and Commodity Murabaha syndicated credit facilities. In January 2025, PIF raised USD7bn through an inaugural Murabaha Syndicated Facility from a syndicate of 20 international and regional financial institutions as part of its medium-term capital raising strategy.

PIF, the sixth largest SWF in the world with current assets under management of an estimated USD925bn, is keen to demonstrate the flexibility and depth of its financing strategy and through the use of diversified funding sources of which Commodity Murabaha is the latest, in its continued drive towards “transformative investments, globally and in Saudi Arabia.”

The Sukuk certificates will be listed on the London Stock Exchange’s International Securities Market in early May 2025.