IsDB Prices its First SOFR-linked Public Sukuk Issuance in 2025 with a USD1.75bn Sukuk Wakala Amid Volatile International Market Conditions

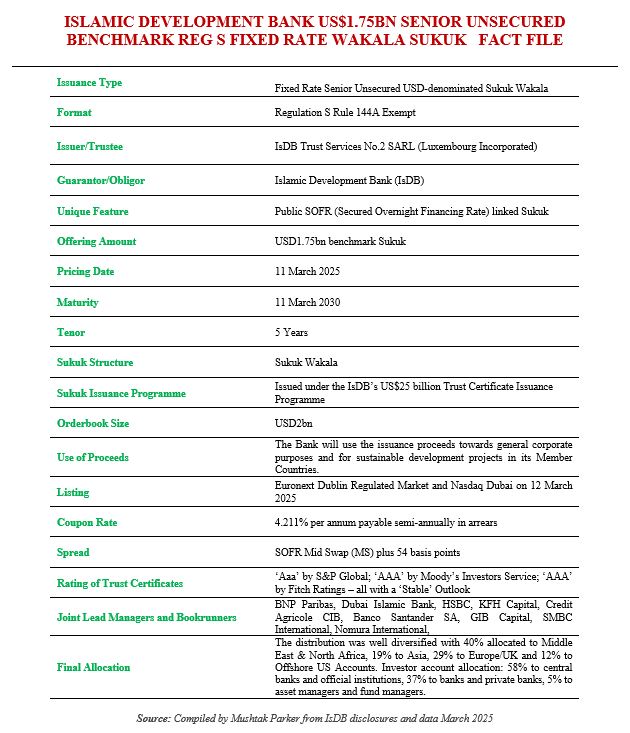

The Islamic Development Bank (IsDB), the multilateral development bank (MDB) of the 57-member OIC (Organisation of Islamic Cooperation) countries and one of the most proactive issuers of Sukuk, successfully priced its first public Sukuk issuance of 2025 – a Fixed Rate Senior Unsecured USD-denominated USD1.75bn Sukuk Wakala offering on 11 March 2025 with a tenor of five years. The structure is based on a Public SOFR (Secured Overnight Financing Rate) Benchmark Sukuk Wakala under the Regulation S Rule 144A Exempt format.

The trust certificates were issued by IsDB Trust Services No.2 SARL (Luxembourg Incorporated) under its US$25 billion Trust Certificate Issuance Programme on behalf of the Guarantor and Obligor, the Islamic Development Bank.

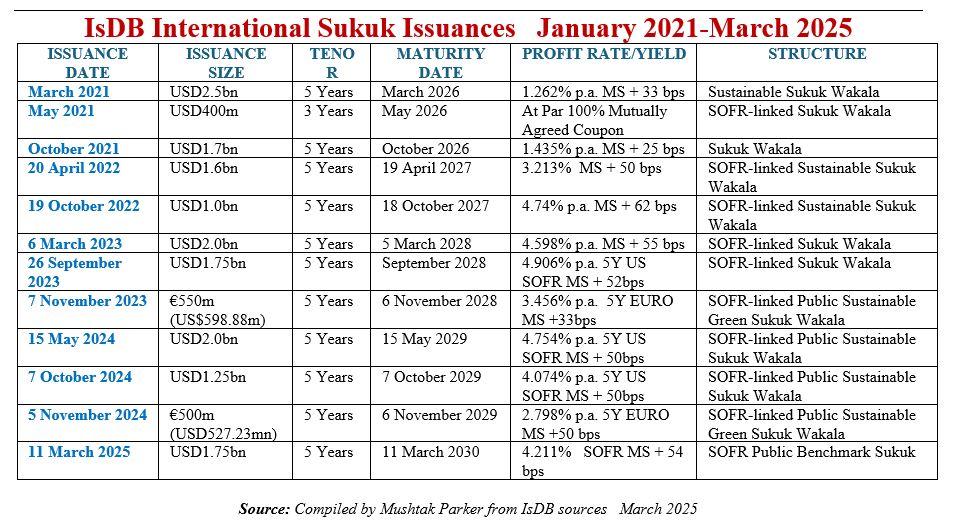

The transaction was successfully issued amidst volatile international market conditions, demonstrating a resilience gained from the IsDB’s long standing presence in the USD Sukuk market. The transaction is the Bank’s first USD benchmark issuance this year, following significant milestones achieved in 2024 that saw the issuance of three successful public benchmark transactions across the Euro and USD markets aggregating USD3.78bn. The other milestone achieved in 2024 was the Bank crossing the USD50bn mark in total Sukuk issuances since it started issuing in 2003.

The IsDB mandated HSBC, BNP Paribas, Credit Agricole CIB, GIB Capital, Dubai Islamic Bank, KFH Capital, Nomura, Santander, and SMBC to act as Joint Lead Managers and Bookrunners to the transaction and to arrange a series of investor calls and roadshows in London, Europe, the GCC, the Middle East, Asia and with Offshore US Accounts.

The 5-year Sukuk transaction was announced to the market on Monday 10 March, with Initial Pricing Thoughts (IPTs) set in the area of US SOFR Mid Swap (SOFR MS) plus 56 basis points (bps). Despite the competing supply from peers across tenors, the investor demand was supportive from the outset resulting in strong indications of interest, that exceeded USD1.4bn.

The orderbook officially opened the following morning on Tuesday 11 March, with guidance set in the SOFR MS plus 55bps area. Investor demand continued to grow above USD2bn allowing the Bank to set the final spread at SOFR MS plus 54 bps, i.e. two basis points tighter from the IPTs. The high-quality investor base enabled the Bank to raise a final size of USD1.75bn. This Sukuk issuance will result in a profit rate of 4.211% per annum for investors, payable on a semi-annual basis and priced at par.

The transaction attracted strong participation from Central Banks and Official Institutions accounting for 58% of the book, followed by Banks and Private Banks (37%) and Asset/Fund Managers (5%). The Bank’s investor marketing activity and credit standing was once again rewarded with new investors that will continue to support future Sukuk issuances. Final allocations were well diversified, with 40% from the Middle East and Africa, 29% from the UK and Europe, 19% from Asia and 12% from Offshore US.

The pricing is broadly in line with the mid-swaps levels achieved in the three 2024 offerings – the May USD2bn Sukuk Wakala was priced at 5Y US SOFR MS + 50bps resulting in a profit rate of 4.754% pa; the USD1.25bn transaction in October was priced at 5Y US SOFR MS + 50bps with a profit rate of 4.074% pa; and the €500mn offering was priced at 5Y EURO MS +50 bps and a profit rate of 2.798% per annum.

Dr. Zamir Iqbal, the Vice President (Finance) and CFO of IsDB, commented: “We are delighted with the overwhelming investor response to our first transaction of 2025, despite the volatile market conditions. The support from both existing and new investors is greatly appreciated and is a testament to the Bank’s strong credit, robust backing from its Member Countries, and attractive profits for investors.”

The IsDB remains the most proactive and prolific issuer of AAA-rated Sukuk in the international market. The Bank is rated Aaa/AAA/AAA by S&P Global Ratings, Moody’s Investors Service and Fitch Ratings (all with Stable Outlook), and has been designated as a Zero Risk Weighted Multilateral Development Bank (MDB) by the Basel Committee on Banking Supervision and the Commission of the European Communities.

With the proceeds of this issuance, the Bank will continue to support projects that deliver socio-economic growth in its 57 Member Countries and Muslim communities globally. The projects are aligned with the Bank’s three overarching objectives under the Bank’s Realigned Strategy, i.e., (a) boosting recovery, (b) tackling poverty and building resilience, and (c) driving green economic growth.

According to Mohammed Sharaf, IsDB Treasurer and Zakky Bantan, Manager of the Capital Markets Division, “this Sukuk issuance marked another important milestone for the Bank, as it continues to expand its investor base and achieve a lower overall pricing. We extend our thanks to all investors for their trust and to the joint lead managers for their diligent work on this endeavour.”

The IsDB last year celebrated its Golden Jubilee. It aims to deliver socio-economic growth in its 57 Member Countries and Muslim communities globally. This covers projects targeting poverty, climate action, food insecurity, and building resilience. The initiatives follow the Bank’s Realigned Strategy, emphasizing on green and resilient infrastructure and inclusive human development.” The interventions are guided by the fit-for-purpose Realigned Strategy of the Bank with a stronger focus on green, resilient, and sustainable infrastructure as well as inclusive human development.

The IsDB Sukuk issuances are driven by its Strategic Realignment Strategy 2023-2025, first approved at the Group’s 46th Annual Meetings in Tashkent in Uzbekistan.

The Bank was the first Islamic financial institution to issue a SOFR-linked Sukuk. The Trust Certificates have been admitted for listing on the Regular Market of Euronext Dublin and NASDAQ Dubai on 12 March 2025.