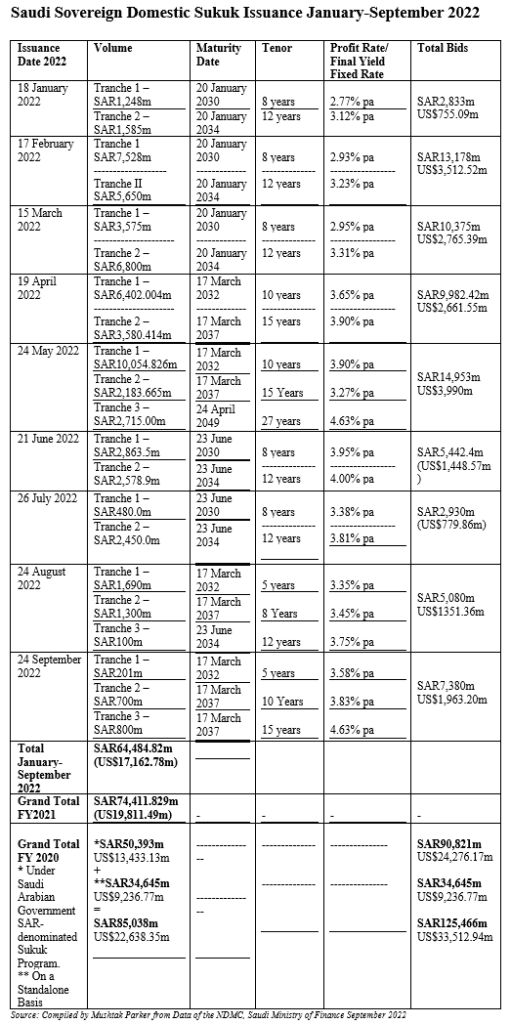

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) Saudi Arabia continued its consecutive monthly Sukuk issuance under its Saudi Riyal-denominated Sukuk Issuance Programme with two auctions – one in August and the second in September 2022 – raising an aggregate SAR4,791million (US$1,274.48 million).

The 23 August 2022 Sukuk auction comprised three tranches with an aggregate SAR3,090 million (US$821.99 million), with total bids reaching SAR5,080 million (US$1351.36 million). The three tranches comprised:

- A first tranche of SAR1,690 million (US$449.57 million) with a 5-year tenor maturing on 23 June 2027 with a yield of 3.35% per annum and a price of 96.85087%. Bids received SAR2,580 million (US$686.32 million).

- A second tranche of SAR1,300 million (US$345.82 million) with an 8-year tenor maturing on 23 June 2030 with a yield of 3.45% per annum and a price of 103.39916%. Bids received SAR1,550 million (US$ 412.32 million).

- A third tranche of SAR100 million (US$26.60 million) with a 12-year tenor maturing on 23 June 2034 with a yield of 3.75% per annum and a price of 105.20890%. Bids received SAR950 million (US$252.72 million).

The 13 September 2022 Sukuk auction comprised three tranches with an aggregate SAR 1,701 million (US$452.49 million), with bids received totalling SAR7,380 million (US$1,963.20 million). The three tranches comprised:

- A first tranche of SAR 201 million (US$53.47 million) with a 5-year tenor maturing on 17 March 2027 with a yield of 3.58% per annum and a price of 95.95539%. Bids received SAR3,156 million (US$839.55 million).

- A second tranche of SAR700 million (US$186.21 million) with a 10-year tenor maturing on 17 March 2027 with a yield of 3.83% per annum and a price of 93.83404%. Bids received totalled SAR1,600 million (US$425.63 million).

- A third tranche of SAR800 million (US$212.81 million) with a 15-year tenor maturing on 17 March 2027 with a yield of 4.07% per annum and a price of 92.17026%. Bids received totalled SAR2,624 million (US$698.03 million).

This follows two auctions – in June and July 2022 – which raised an aggregate SAR8,372 million (US$2,228.32 million). This means that in the first nine months of 2022 the Saudi Ministry of Finance issued an aggregate SAR64,484.82 million (US$17,162.78 million) of Sukuk. In the same period in 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR65,741.315 million (US$17,491.51 million). In dollar terms, the figures for the two years are about the same, albeit in Saudi riyal terms it was slightly higher in 2021. Whether this indicates a slowing down of Sukuk issuance in volume due to higher oil prices and therefore greater revenues remains to be seen.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2022 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The true figure of the Kingdom’s domestic sovereign Sukuk issuance activity assumes even greater importance if we include “the standalone Sukuk issued by the NDMC in March 2022 under the Sukuk Issuance Programme in Saudi Riyal with a total value around SAR26.2 billion (US$6.98 billion) to unify the Kingdom’s domestic issuances under the Sukuk Issuance Programme in Saudi Riyal, that represents the third phase of this initiative which was started in 2020 and it will continue until unifying all domestic debt outstanding.”

This means that the actual aggregate volume of sovereign domestic Sukuk issued by the NDMC in the first nine months of 2022 reached SAR91,941.315 million (US$24,458.81million).

The NDMC is currently working on attracting new capital, and international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. In August 2022, for instance, the Ministry of Finance and the NDMC appointed Al Rajhi Capital Company and Al Rajhi Banking & Investment Corporation to replace Riyad Capital Company and Riyad Bank in the Primary Dealers Program.

The Saudi market received a major boost in September 2022 following the decision of the Ministry of Finance and the Saudi Central Bank (SAMA) to establish a unified and independent insurance regulator in the Kingdom.

According to Brandan Holmes, Vice-president, Senior Credit Officer at Moody’s Investor Services, “the formation of a unified and independent insurance regulator in the Kingdom of Saudi Arabia, along with the Finance Minister’s support of insurance M&A, will contribute to strengthening of the sector which has recently suffered from weak profitability driven by intense competition and lack of pricing discipline.’’