Turkish Treasury Keeps Domestic Sovereign Sukuk Al Ijarah Auctions Momentum Going in March and April 2022 with Aggregate Volume Reaching TRY34,057.9m (US$2,321.2m) in Q1 2022

Ankara – Sovereign domestic currency lease certificates (Sukuk Al-Ijarah) issuance is becoming a regular feature of the fund-raising strategy of The Debt Office of the Turkish Treasury and Finance Ministry.

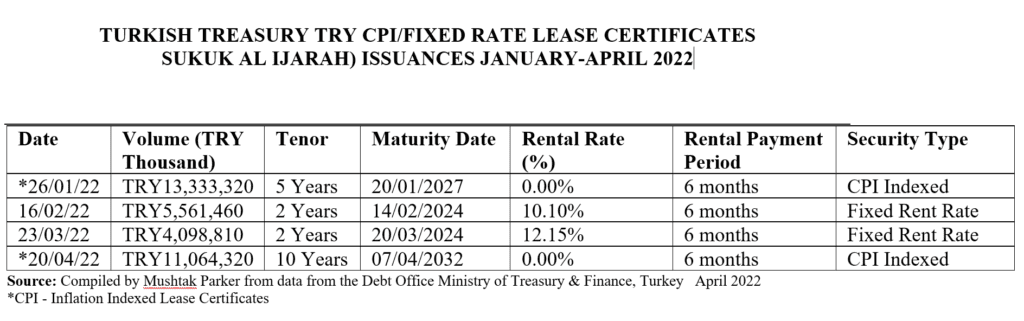

Following the Ministry’s 5-year US$3bn Sukuk Al Ijarah offering in the international market in February 2022, priced at a leasing rate and yield to investors of 7.250% per annum and a spread of MS (Mid Swaps) + 524.7 basis points, the Treasury held two auctions of Turkish lira-denominated lease certificates in March and April 2022. This follows similar auctions in January and February 2022.

In March, the Treasury raised TRY4,099.8 million (US$279.35 million) through a 2-Year fixed rate Sukuk Al Ijarah issuance maturing on 20 March 2024 and priced at a fixed rental rate of 12.15% payable every six months. This was followed by CPI Indexed TRY11,064.3 million (US$754.14 million) 10-Year Sukuk Al-Ijarah offering in April 2022 and was priced at a fixed rental rate of 0.0 %.

In January 2022 the Treasury raised TRY13,333.32 million (US$910 million) through a CPI Indexed Lease Certificate issuance and in February it raised TRY5,561.46 million (US$378.12 million) through a 2-year Fixed Rate Lease Certificate transaction.

All the above Lease Certificate issuances were done through a direct sale auction conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems). The four consecutive monthly auctions bring the total Sukuk issuance volume for the January to April 2022 period to TRY34,057.91 million (US$2,321.22 million)

The Turkish Treasury is a proactive issuer of lease certificates (Sukuk Al-Ijarah) as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates/bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury is that it is issuing the lease certificates “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a wholly-owned special purpose vehicle owned by and on behalf of the obligor, the Ministry of Treasury & Finance. The Ministry of Treasury & Finance issues these lease certificates “in order to increase domestic savings, broaden the investor base and diversify the borrowing instruments.”

According to Treasury data, domestic debt redemption in April 2022 is projected at TRY22.6 billion, while domestic borrowing is projected as TRY27 billion; in May, domestic debt redemption is projected as TRY53.3 billion, while domestic borrowing is projected as TRY59 billion; and in June, domestic debt redemption is projected as TRY19.2 billion, while domestic borrowing is projected as TRY28 billion.

This suggests that the Treasury will be accessing the Sukuk market for the next quarter as in line with President Recep Tayyip Erdogan’s stated policy of using the Islamic capital market more proactively in the country’s debt financing strategy.

SAMA Licences Four More Fintech Firms in Electronic Payments, Debt Crowdfunding and Microfinance to Boost Financial Inclusion

Riyadh – Further signs of the proliferation of FinTech in the Saudi financial and payments sector are the licensing of three new companies specialized in finance and electronic payments by the Saudi Central Bank (SAMA) on 28 March 2022.

The first license was granted to Etihad Fintech Company for its new “Mobily Pay” electronic payments platform. The company is now licensed to provide e-wallet payment services in the Kingdom, thus bringing the total number of payment companies licensed by SAMA to 17, in addition to 8 companies that were granted an “In-Principle Approval”.

SAMA also kick-started the licensing of Debt-based Crowdfunding by granting “Lendo”, a closed joint stock company with a capital of SAR5 million, a license to conduct Crowdfunding activities within the Kingdom after a successful trial ran through SAMA’s Regulatory Sandbox dedicated to innovative financial products and services within Saudi Arabia.

Lendo is the Kingdom’s first company specialising in Sharia’a compliant debt crowdfunding. In March 2021 the company announced the closing of a SAR27 million funding round led by Derayah Ventures, with participation from Seedra, and Shorooq Partners.

Osama Al Raee, CEO and Co-Founder of Lendo, expects business to take off following the crowdfunding licence with prospects of expanding the business in the wider Middle East and North Africa region.

According to Mohamed Jawabri, Co-Founder and COO of Lendo, the company financed more than 400 invoices worth more than SAR300 million for small and midsized businesses (SMBs) in the Kingdom in the last few years.

Lendo plans to launch new products in the coming months, including for small and medium-sized enterprises (SMEs). The company is optimistic that Islamic finance will contribute around 80% of its balance sheet by 2023, which may prompt the shareholder to seek a licence to operate an Islamic digital bank.

The Saudi Central Bank also issued a second licence to FinZey, a closed joint stock company with a capital of SAR20 million to conduct consumer microfinance activities in Saudi Arabia.

These initiatives come as part of SAMA’s role in strengthening and widening the scope of the finance and payments-processing services sector by allowing them to engage in new activities and to attract a wider pool of investors and companies.

The aim of SAMA is to increase the effectiveness and flexibility of financial transactions, enabling and encouraging innovations in financial services, enhancing the level of financial inclusion in the Kingdom, and enabling easy and safe access to financial services to all segments of the Saudi society.

In addition, SAMA also gave a licence to Sulfah Financing Company, a closed joint-stock company with a capital of SAR10 million, to conduct Fintech-based consumer microfinance activity in the Kingdom.

This follows a successful pilot run by Sulfah in SAMA’s Regulatory Sandbox. The Saudi central bank stresses that will continue to provide licenses to companies promoting microfinance, which it believes would greatly support and empower the Kingdom’s finance sector as it broadens its scope of activities, draw more investors and encourage medium capital companies to enter the sector.

The above activities also fall within the strategy of SAMA to promote financial inclusion in the country through enabling Fintech. Financial inclusion was in fact the main theme of SAMA’s quarterly Islamic Finance workshop held virtually in March 2022. The Workshop, titled “the Role of Financial Inclusion in enhancing the Islamic Finance Industry both in Theory and Practice”, attracted a wide range of industry’s experts and stakeholders and included a special session on the role of technology and Fintech in enhancing financial inclusion.

Saudi-based Gas and Oil Drilling Company Arabian Drilling Company Raises SAR2bn (US$533m) from the Local Debt Market in March 2022 through a Debut Domestic Floating Rate Sukuk Issuance

Jeddah – Arabian Drilling Company (ADC), a Saudi-based gas and oil drilling company established in 1964, successfully raised SAR2 billion (US$533 million) from the local debt market in March 2022 through a debut domestic floating rate Sukuk issuance.

ADC is a limited liability partnership between the Industrialization & Energy Services Company (TAQA), which owns 51%, and Services Petroliers Schlumberger S.A. TAQA is 45% owned by the Public Investment Fund, the Kingdom’s sovereign wealth fund. Company operations started with only one drilling rig in 1964 and expanded currently to 45 onshore and offshore rigs for gas and oil drilling.

ADC mandated HSBC Saudi Arabia to act as Lead Coordinator of the transaction whereas HSBC and Saudi Fransi Capital were the joint lead managers for the transaction. Riyad Capital was appointed as the Sukukholders’ agent and payment administrator.

The transaction attracted large demand from various qualified investor groups and accounts. The final order booked reached more than SAR5.5 billion which allowed the company to upsize the issuance size from its original plan of SAR1.6 billion to SAR2 billion.

The robust demand also allowed the Sukuk pricing to tighten at a final Sibor+160 basis points which was the low end of the initial price guidance.

The Sukuk, which has a tenor of nine years maturing on 9 December 2031, was priced at a coupon rate of 3.5% per annum, to be paid semi-annually.

“ADC has an established strong name in the oil industry for many years,” reminded Ali Alghamdi, Managing Director Administration at ADC. “The Sukuk issuance was mainly designed to expand the awareness of ADC’s impressive operational and financial track record to the wider market. The current conditions in the energy market is ideal for growth opportunities and such Sukuk financing will allow ADC to continue its journey to comfort its position as a leading national and future regional player in its field.”

Securities Commission Malaysia Registers Two Initial Exchange Offering (IEO) Operators in March 2022 to Promote Responsible Innovation in the Digital Assets Space

Kuala Lumpur – The Securities Commission Malaysia (SC) registered two Initial Exchange Offering (IEO) operators, Kapital DX Sdn Bhd and Pitch Platforms Sdn Bhd, in March 2022 to promote responsible innovation in the digital assets space.

The registered IEO operators, says the SC, “will provide an alternative avenue for eligible companies to raise funds via the issuance of digital tokens in Malaysia. An issuer may raise funds up to RM100 million from retail, sophisticated, as well as angel investors, subject to the investment limits provided in the SC’s Guidelines on Digital Assets.”

These new operators will be required to carry out the necessary assessments, among others, to verify the issuer’s digital value proposition, review the issuer’s proposal and disclosures in its Whitepaper, and undertake a comprehensive due diligence on the issuer and its token offering, prior to hosting the issuer’s digital token on their platform.

In addition, they will be given up to nine months to comply with all the regulatory requirements before commencing operations, and this includes putting in place a robust and effective Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) process to mitigate Money Laundering and Terrorism Financing (ML/TF) risks.

The SC stresses that members of the public are not permitted to offer, issue or distribute any digital assets, which has been prescribed as securities, in Malaysia without obtaining a registration or authorisation from the SC. In this regard, a person convicted may be liable to a fine not exceeding RM10 million or imprisonment for a term not exceeding 10 years or both.

ICD Arranges US$50m Syndicated Murabaha Facility for Indonesia’s PT Mandala Multifinance Tbk to Support Private Sector Development

Jakarta –The Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group, arranged a Syndicated Murabaha financing facility in March 2022 for PT Mandala Multifinance Tbk (MFIN) to support the development of the private sector in Indonesia.

The facility, which was lead arranged by ICD with the participation of Ajman Bank, has a tenor of four years. ICD underwrote US$30 million of the facility with the rest provided by Ajman Bank.

The local bank, PT Bank CIMB Niaga Tbk, acted as the Investment Agent, Facility Agent, and Security Agent for this transaction, which was signed at the side line of the Global Islamic Investment Forum held in Jakarta in March 2022.

The proceeds of the Murabaha financing will be used for the financing of new two-wheeled motor vehicles, targeted to be leased to SMEs as well as self-owned entrepreneurs, which are important sectors in supporting the growth of the Indonesian economy.

“Indonesia is a key market for ICD, and we hope that this Line of Financing will help to further increase SME access to Sharia’a-compliant funds and enhance their engagements with the national economy,” stressed Ayman Sejiny, Chief Executive Officer of ICD.

The facility, he added, will also enable MFIN to further provide financing to the SMEs and assist them in expanding their businesses. ICD, he confirmed, plans to increase its activities and financing to Indonesia’s private sector and financial institutions in the coming years and strengthen ICD’s partnership with the country.

Harryjanto, the President Director of MFIN explained that “ICD has been instrumental in PT Mandala’s rapid growth and the new funds mobilized by ICD will indeed add a new dimension to the business, especially seeing that it had attracted financial institutions from the Middle East. Over the years, Islamic finance has notably served as a viable funding mechanism for various economic sectors, thus demonstrating its viability as an engine of growth.”

This syndicated Murabaha LOF facility marks the fourth collaboration between MFIN and ICD. To date ICD has arranged US$123 million of Murabaha financing to MFIN to meet its funding needs for financing private enterprises in Indonesia.

Malaysia’s Mortgage Securitiser Cagamas Berhad Continues Issuance Momentum with RM300m (US$69.91m) 1-year Floating Profit Rate Islamic Medium-Term Notes Issuance in April 2022

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, continued its Sukuk issuance momentum with a RM300 million (US$69.91 million) 1-year Floating Profit Rate Islamic Medium-Term Notes (IMTNs) issuance on 13 April 2022.

The transaction says Cagamas represents the Company’s first IMTNs with floating rate mechanisms since June 2014.

“The successful conclusion of the Company’s IMTNs,” explained Cagamas President/ Chief Executive Officer, Datuk Chung Chee Leong, “represent Cagamas’s ongoing efforts in developing onshore capital markets through the issuance of diversified structures, catering to market needs in current interest rate environment that contributes positively to the depth and breadth of the domestic Sukuk market.”

The IMTNs, with their floating rate mechanism, were attractive to investors as they provide potential higher returns amid a rising interest rate environment and were successfully priced via private placement at the corresponding 3-month Kuala Lumpur Interbank Offered Rate (KLIBOR) or equivalent to 2.12% based on KLIBOR fixing on the pricing date. The new issuance brings the Company’s aggregate issuances for the year to RM5.6 billion.

The papers, which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu and with all other existing unsecured obligations of the Company. The proceeds from the Cagamas issuance are used to fund the purchase of eligible sustainability assets, housing finance loans and Islamic home financing from the financial system.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia.

Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM321.595 billion worth of corporate bonds and Sukuk.

IILM Continues Consecutive Monthly Auctions in March and April 2022 with an aggregate US$2.48bn Reissuance of Short-Term A-1 Rated Sukuk

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM) completed its regular monthly issuances of its short-term Sukuk issuance programme for 2022 in March and April respectively. On 14 March it successfully completed the auction for the reissuance of an aggregate US$1.20 billion short-term “A-1” rated Sukuk across three different tenors of one, three, and six-months.

The March auction for the three series of re-issuances totalling US$1.20 billion, priced by the market as follows:

- US$480 million of 1-month tenor certificates at 0.53%

- US$500 million of 3-month tenor certificates at 1.03%

- US$220 million of 6-month tenor certificates at 1.25%

This latest reissuance follows a similar three tranche transaction in February 2022 totalling US$1.21 billion. All the above transactions come under IILM’s US$3.51 billion short-term issuance programme.

The March auction, says the IILM, “garnered strong demand” from GCC-based Primary Dealers and investors across the GCC markets as well as Asia, resulting in a strong orderbook in excess of US$1.68 billion, representing an average oversubscription ratio of 1.32 times and average bid-to-cover ratio of 1.40%.

On 18 April the IILM successfully completed another auction for the reissuance of an aggregate US$1.28 billion short-term “A-1” rated Sukuk across three different tenors of one, three, and six-months.

The April auction for the three series of re-issuances totalling US$1.28 billion, priced by the market as follows:

- US$600 million of 1-month tenor certificates at 0.75%

- US$380 million of 3-month tenor certificates at 1.28%

- US$300 million of 6-month tenor certificates at 1.78%

“Despite a challenging and highly volatile operating environment, we are pleased that the IILM is able to continue fulfilling the liquidity needs of the Islamic markets, with issuance for all tenors fully subscribed at a competitive all-in profit-rates,” maintained Dr. Umar Oseni, Chief Executive Officer of the IILM.

The April re-issuance marks the IILM’s fourth Sukuk auction for 2022. The auction, added the Corporation, garnered significant interest among Islamic Primary Dealers and investors across the GCC markets as well as Asia. The competitive tender witnessed a strong orderbook in excess of US$1.64 billion, representing an average bid-to-cover ratio of 128%.

“The April auction,” added Dr Oseni, “saw a strong interest for the 1-month and 3-month tenors of the IILM’s papers, on the backdrop of a global rise in interest rates and tighter policy by the Federal Reserve. Overall, we are pleased that the IILM’s issuance this month for all tenors were fully subscribed at competitive all-in profit rates, despite the current market condition on the back of geopolitical developments all around the world. The IILM continues to provide investors with an international safe-haven investment solution to manage their liquidity needs in the Islamic markets with sufficient flexibility.”

The IILM has achieved year-to-date cumulative issuances totalling US$4.69 billion through 12 Ṣukuk series. According to the IILM, the Corporation will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The IILM has issued a total of US$79.96 billion across 173 short-term Sukuk issuances over the last eight years, reflecting the organisation’s ability to provide high quality Sharia’a compliant instruments and reliable offerings to Primary Dealers and investors, as well as offering stability to the global Islamic liquidity market.

The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services.

The IILM’s short-term Sukuk programme is rated “A-1” by S&P with current outstanding issuance size amounting to US$3.51 billion. According to the IILM, the primary dealers that participated in the auction conducted under the competitive bidding of the Bloomberg AUPD Platform included Abu Dhabi Islamic Bank; Al Baraka Turk Participation Bank; Barwa Bank; Boubyan Bank; CIMB Islamic Bank Berhad; First Abu Dhabi Bank; Kuwait Finance House; Macquarie Bank; Maybank Islamic Berhad; Qatar Islamic Bank; and Standard Chartered Bank.

Pakistan Islamic Banking Sector Shows Strong Growth Across the Board in FY2021 with Market Share of Assets and Deposits of Total Banking Sector Reaching 18.6% and 19.4%

Islamabad – Pakistan’s Islamic Banking Industry (IBI) recorded strong growth in FY 2021 with total assets surpassing the 5 trillion rupees mark to reach Rs5,577 billion (US3,018.00 million) with the highest ever year-on-year increase of Rs1,308 billion, whereas deposits reached Rs4,211 billion with an increase of Rs822 billion. State Bank of Pakistan (SBP) reported this today in its Islamic Banking Bulletin for the quarter ending December 2021.

According to data published in the Islamic Banking Bulletin of the State Bank of Pakistan (SBP), assets of IBIs grew by 30.6% in FY21, while deposits increased by 24.2% during the same period. As a result of this strong growth, the market share of Islamic banking assets and deposits in the overall banking industry increased to 18.6% and 19.4%, respectively by end December 2021.

The increase in assets of IBIs was driven by both financing to the private and public sectors and investments in Sharia’a compliant securities. Financing by the IBI recorded a rise of Rs716 billion (38.1%) during FY21, which is also the highest ever increase during a year. Further, investments of IBI witnessed a growth of Rs591 billion (46.9%) during FY21 on the back of domestic sovereign Sukuk issued by the Government of Pakistan.

On the funding side, current deposits and saving deposits of IBIs witnessed significant increase of Rs441 billion and Rs277 billion respectively during FY21. The deposit growth is also due to the increased availability of Islamic banking services in the country with the addition of 500 new Islamic banking branches. The total number of Islamic banking branches now stand at 3,956 across 125 districts, which is around 25 % of the total number of commercial bank branches in the country.

IBIs, says the SBP, have played a significant role in the implementation of various measures taken in the wake of the COVID 19 pandemic and several other key initiatives to promote financing for low cost housing and SMEs and digitization.

During the COVID 19 pandemic, the SBP introduced Temporary Economic Refinance Facility (TERF) – a concessionary refinance facility aimed at promoting investment both new and expansion and/or Balancing, Modernization and Replacement (BMR) that has been highly appreciated by the business community. In the disbursement of financing under TERF, the IBIs also contributed significantly with a sizable share of 38% in total amount disbursed.

Similarly, under the flagship initiative of Mera Pakistan Mera Ghar, a financing facility to promote affordable housing, the share of IBIs has been 49% in total disbursements and 58% in total approved amount of financing. In case of Roshan Digital Account, Islamic Banks have been able to attract sizable investment in Islamic Naya Pakistan Certificates (INPCs) with a share of 46% to total inflows under NPCs.

Islamic banking has been witnessing robust growth over the last few years on the back of SBP’s leading role in creating a conducive environment for the expansion of Islamic banking industry. It remained an important pillar of SBP’s strategy to promote financial inclusion in the country.

Key initiatives taken by SBP during FY21 include: i) issuance of the 3rd five year strategic plan 2021-25 for the Islamic banking industry providing a roadmap and headline targets; ii) introduction of Sharia’a compliant standing ceiling facility & open market operations, iii) development of the transaction structure of Government of Pakistan domestic Ijarah Sukuk for fresh issuance(s) & its re-opening thereafter with multiple assets; iv) issuance of Sharia’a compliant regulations for the lender of the last resort facility, v) issuance of instructions on Sharia’a non-compliance risk management instructions; vi) strengthening of Sharia’a governance mechanism; and vii) numerous initiatives for creating awareness of Islamic finance among the general public and capacity building of relevant stakeholders.

Malaysia’s MBSB Bank Launches Maiden RM300m (US$69.91m) Sustainability Sukuk Wakalah Under its RM5bn Programme

Kuala Lumpur – MBSB Bank Berhad (formerly Asian Finance Bank) successfully priced its inaugural RM300 million (US$69.91 million) Sustainability Sukuk Wakalah issuance in April 2022 under its dedicated RM5 Billion Sustainability Sukuk Wakalah Programme.

The issuance, says MBSB Bank, was priced amidst the volatile market conditions and selling pressures seen on the domestic government securities in response to the rising global yield. The offering marks the first ever Sustainability Sukuk issuance by an Islamic bank locally, in its continued effort to grow its sustainable assets which underscores its commitment towards its sustainability agenda.

MBSB Bank will use the proceeds received from the Offering to finance its green and social related projects which is in line with the Bank’s strategic plan to actively participate in renewable energy and essential services in accordance with the bank’s Sustainability Sukuk Framework issued to govern the issuance of the Sustainability Sukuk.

The transaction, which was priced on 4 April 2022, received overwhelming demand from diversified investors ranging from institutional investors, insurance and takaful companies, fund and asset management companies, financial institutions and high net worth investors with a final order book received amounting to RM2.9 billion, giving the transaction a strong bid to cover ratio of 10 times.

Interest from investors, stressed MBSB Bank, remained strong throughout the book-building process, allowing the Sustainability Sukuk Wakalah pricing to be further tightened by 30 basis points across the tenures from the high end of the initial price guidance. The dual-tranche Offering — RM200 million 5-year tranche and a RM100 million 7-year tranche — were finally priced at Malaysian Government Securities + 95 basis points or a final yield of 4.36% per annum and 4.73% per annum respectively.

Maybank Investment Bank Berhad was the Sole Lead Manager and Bookrunner for the transaction as well as the Sole Principal Adviser, Sole Lead Arranger and Sole Sustainability Structuring Advisor for the Sustainability Sukuk Wakalah Programme.

Commenting on the transaction, MBSB Bank’s Acting Chief Executive Officer, Datuk Nor Azam M Taib, said: “The Offering marks our first Sustainability Sukuk issuance in the domestic capital markets which demonstrates MBSB Bank’s strong commitment towards supporting the government’s sustainability agenda and initiatives. We are indeed very pleased with investors’ strong response and the outcome of the transaction.”

He also expressed his gratitude towards the UK government’s Foreign, Commonwealth and Development Office for its UK-ASEAN Low Carbon Energy Programme: “We would like to express our gratitude to the UK Government’s ASEAN Low Carbon Energy Programme (LCEP) for the support towards the development of MBSB Bank’s Sustainability Sukuk Framework. The programme promotes inclusive economic growth in Southeast Asia through increased green finance flows for low carbon energy and energy efficiency.”

According to Maybank Investment Bank’s Chief Executive Officer, Dato’ Fad’l Mohamed, “The final pricing and strong demand clearly reflects investors’ confidence in MBSB Bank, as well as an endorsement of its sustainability commitments. The supply scarcity of sustainability offerings in the market further helped to drive demand.”

The RM5 billion Sustainability Sukuk Wakalah Programme was launched in February 2022 and arranged by Maybank Investment Bank. The Sustainability Sukuk Programme is MBSB Bank’s first sustainability Sukuk platform and according to the bank “will be the first of its kind in the world to be issued by an Islamic bank.” The Sustainability Sukuk Wakalah Programme will have a perpetual programme tenure and has been accorded a preliminary rating of A+IS by Malaysia Rating Corporation Berhad.

In addition, according to Datuk Nor Azam, “the Sustainability label attached to our Sukuk offers diversification to investors as we acknowledge there is a growing demand of Sustainability Sukuk in the market and this enables the bank to have access to a larger pool of investors including those with dedicated ESG mandates.”

MBSB Bank’s Sustainability Sukuk Wakalah Programme, he added, is in compliance with the relevant sustainability frameworks such as the Securities Commission Malaysia’s Sustainability and Responsibility Investment Sukuk Framework, the ASEAN Capital Markets Forum’s Green, Social and Sustainability Bond Standards, and the International Capital Markets Association’s Green, Social and Sustainability Bond Principles.

IsDB Approves US$180m Co-Financing Towards Pakistan’s US$590m Mega Mohmand Dam and Hydropower Project

Islamabad – The Islamic Development Bank (IsDB) signed a US$180 million financing agreement with the Government of Pakistan towards the financing of the mega Mohmand Dam and Hydropower Project.

In addition to the IsDB financing, the OPEC Fund for International Development, the Kuwait Fund for Arab Economic Development, and the Saudi Fund for Development will join in as members of the Arab Coordination Group to co-finance the remaining US$410 million of project costs.

IsDB Group President Dr. Muhammad Al Jasser, at the signing ceremony, stressed that “the Islamic Development Bank takes pride in working alongside its partners to support Pakistan in such a strategic project of national importance. We are working with other players from the Arab Coordination Group to develop a multi-purpose dam that will not only enhance energy and water supply but also the livelihoods of the local communities and better protect them against floods. The financing is in line with the IsDB Group’s commitments to allocate more financing to climate-friendly projects.”

Located in Pakistan’s Khyber-Pakhtunkhwa (KP) Province, the Mohmand Dam and Hydropower Project is a national priority and lifeline for the country which aims to contribute to national energy and water security, as well as the regional socioeconomic development in KP Province.

Once completed, says the IsDB, this new multi-purpose dam will enhance energy generation and provide sustainable water resources for agriculture and human consumption in KP, thus uplifting the livelihoods of marginalized communities, while improving the region’s resilience to floods.

The project is expected to add 800 MW to Pakistan’s installed hydropower capacity and generate approximately 2,862 GWh annually, provide nearly 13.32 m3/second of potable water to two million inhabitants in Peshawar city, help irrigate and initiate agricultural activities on 6,773 ha of new land and increase the existing cropping area from 1,517 ha to 9,227 ha.

It will also support Pakistan’s efforts to achieve the goal stated in its Vision 2025 of more than doubling its installed hydropower capacity by 2030 and help achieving several of the UN SDGs.

When operational, the Mohmand Dam will be the fifth highest Concrete-Face-Rock-Filled Dam (CFRD) in the world and will create an active storage reservoir of approximately 1,594 million m of capacity. The first power-generating unit is scheduled to be operational by December 2025.

IsDB’s ISFD and UNHCR Launch Ground-breaking Global Islamic Fund for Refugees Aimed at Opening New Islamic Philanthropy Funding Streams in Support of Millions of Forcibly Displaced People

Jeddah – The United Nation High Commission for Refugees, UNHCR, and the Islamic Solidarity Fund for Development (ISFD), the poverty alleviation arm of Islamic Development Bank (IsDB) Group, signed an agreement in March 2022 to launch the Global Islamic Fund for Refugees (GIFR).

The promoters aim for GIFR is to be “an innovative sustainable and Sharia’a-compliant resource mobilization instrument that will open new Islamic philanthropy funding streams in support of millions of forcibly displaced people.” The GIFR will endeavor to mobilize additional funding in support of humanitarian programs and operations, in situations of forced displacement across sectors.

The agreement comes at a time when forced displacement has reached unprecedented levels and has become a critical global humanitarian and development crisis, requiring intensive, comprehensive, and collaborative international action.

IsDB Group President, Dr Muhammad Al Jasser, reiterated at the signing that “forced displacement needs are at a record high and continue to rise. No institution alone could carry the burden. We need to strengthen existing partnerships and explore innovative solutions for the plight of the forcibly displaced. We are proud of our partnership with UNHCR and are confident that our joint efforts will provide the necessary mechanisms to assist those in need.”

The initiative aims to provide effective, efficient, and predictable support to programs and projects for refugees, Internally Displaced Persons (IDPs) and host communities in the OIC member states, a region that produces and hosts the highest number of global refugees.

“Millions of people continue to be forced from their homes due to war, violence, persecution and discrimination and they need and deserve our support. Innovative sources of Islamic social financing, such as this ground-breaking agreement with the Islamic Development Bank, will enable UNHCR to help refugees and other forcibly displaced people with the protection and assistance needed to live in better, more dignified conditions. We are grateful to ISFD for its steadfast support and ongoing partnership. This initiative will unlock much-needed financial support to address the dire needs of those forcibly displaced,” emphasised UNHCR’s High Commissioner Filippo Grandi.