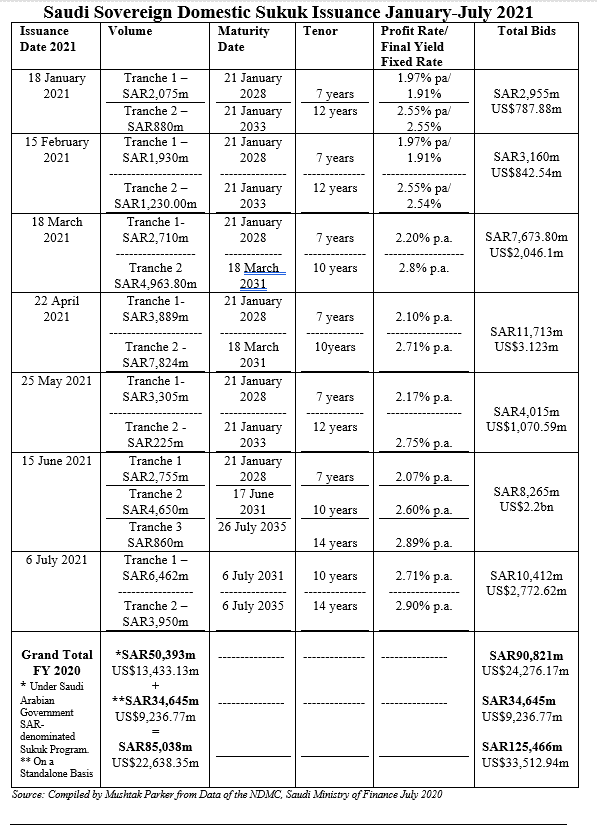

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) issued its seventh consecutive monthly issuance of Riyal-denominated sovereign Sukuk with a two-tranche SAR10.412 billion (US$2,772.62 million) offering on 6 July 2021.

This follows the closing of a similar three-tranche SAR8.265 billion (US2.20 billion) offering in June 2021 – all under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme. This means that in the first seven months of 2021, the NDMC has raised the equivalent of SAR44,553.065 million (US$14,074.01 million) through seven domestic sovereign Sukuk issuances.

The SAR10.412 billion (US$2,772.62 million) offering comprised two tranches offered through two auctions held on 6 July 2021:

1. A first tranche of SAR 6.462 billion (US$1,723.25 million) with a 10-year tenor maturing on 5 July 2031 and priced at a final fixed profit rate/yield of 2.71% per annum, with total bids amounting to SAR 6.462 billion (US$1,723.25 million); and

2. A second tranche of SAR 3.950 billion (US$1,053.36 million) with a 14-year tenor maturing on 5 July 2035 and priced at a final fixed profit rate/yield of 2.90% per annum, with total bids amounting to SAR 3.950 billion (US$1,053.36 million).

The NDMC’s Domestic Sukuk Issuance Calendar for 2021 commits to a consecutive monthly Sukuk issuance strategy from January to December 2021. No other jurisdiction has committed to such a dedicated domestic Sukuk issuance regime in 2021. Moody’s Investors Services in October assigned (P)A1/Aaa.sa rating to the Government’s Saudi-riyal denominated Sukuk Programme for 2021.

Last year, according to data compiled by Mushtak Parker for this newsletter from MoF statistics, the NDMC issued under its Sukuk Issuance Programme domestic Sukuk totalling SAR50,393 million (US$13,433.13 million) with total bids amounting to SAR79,100 million (US$21,085.17 million). In addition, the NDMC also raised SAR34,645 million (US$9,236.77 million) from a four-tranche standalone auction last July, bringing the total Saudi-riyal denominated Sukuk issued by the government in 2020 to SAR85,038 million (US$22,638.35 million), which is almost a 50% increase on the previous year.

Saudi Sukuk issuance is expected to sustain its buoyancy in the second half of 2021. In July 2021, the Board of Directors of the NDMC, chaired by Minister of Finance, Mohammed Al-Jadaan, appointed Hani Al Medaini as Acting CEO of the NDMC with immediate effect. He replaces Fahad Al Saif, who has taken up a senior post at the Public Investment Fund.

The Kingdom received a double boost in July. The IMF in its Concluding Statement of the 2021 Article IV Consultation with Saudi Arabia reaffirmed the continued recovery of the Saudi economy and the slowdown of inflation (Consumer Price Index (CPI), and projected non-oil GDP growth will reach 4.3% this year and 3.6 % in 2022.

The IMF expects the private sector will lead growth this year to reach 5.8%, and it will continue in the medium and long term with an average growth of 4.8%.

The Fund staff commended the Saudi government’s swift and decisive response to COVID-19 Pandemic, and the early creation of a Supreme Crisis Committee to manage and coordinate the efforts between government agencies, along with the ambitious reforms that were being implemented earlier within the framework of the Saudi Vision 2030.

These included the growing digitization of government and financial services, reforms to increase labour market mobility, and strong policy buffers all meant the economy was well equipped to manage the COVID crisis. Moreover, the Private Sector Financing Support Programme, launched by the Saudi Central Bank, contributed to supporting SMEs in facing the challenges of the pandemic.

Other IMF observations projected that the “Shareek” partnership programme will offer incentives through the tax system, access to credit, and regulatory reforms to encourage investment; that the labor market reforms (cancelation of Kafala sponsorship system) will result in a more competitive labor market that is more attractive to higher skilled expatriates and a continued rise in female labor force participation rates, which has increased by 13% to over 33% over the past two years.

The IMF staff also projected that lines of credit to the private sector will grow strongly, boosted by lending for housing and to SMEs. They also project the new social security law to be an important step to strengthen the framework for providing income support to the less well off.

On public finance and transparency, the IMF staff confirmed that significant progress has been made recently to increase accountability and transparency in public procurement, including through the “Etimad Platform”. They commended the impressive pace of capital market reforms to increase liquidity and depth to local equity and bond markets including giving greater access to foreign investors and introducing financial derivatives products.

Minister of Finance, Mr. Mohammed Al-Jadaan, said that the Concluding Statement highlighted the current and future indicators of the Saudi economy and that it succeeded in overcoming many of the obstacles and challenges that the world underwent in 2020 through to 2021. This contributed to achieving the financial sustainability that enhanced the economy’s robustness and strength.

Also in July, Fitch Ratings affirmed Saudi Arabia’s credit rating at “A” and revised the outlook to stable from negative. According to Fitch, the outlook revision “reflects prospects for a smaller decrease in the budget deficit than at the time of the previous review, owing to significant oil price improvements and continued government commitment to fiscal consolidation and economic reforms”.

After the economic contraction in 2020, Fitch projects signs of an economic recovery in the Kingdom, with the current account returning to a surplus of 2.7% in 2021 and the budget deficit decreasing from -8.4% in 2020 to -3.3% of GDP in 2021.

Saudi real GDP is forecast at 2.1% in 2021 compared with a contraction of -4.1% in 2020.

Similarly, government debt is projected to reach 31.1% of GDP in 2021, down from 39.4% in 2020, and expected to reach 33.1% in 2023. Minister of Finance Al-Jadaan said that Fitch’s revision of Saudi Arabia’s outlook from negative to stable affirms the positive reforms that been taken by the government during the last five years through Saudi Vision 2030.

Sukuk issuance, which is particularly suited to financing infrastructure and urban regeneration, is also relevant in the context of the efforts of the G20 to boost investment in these sectors, and through privatisation.

“Our aim is to secure about US$55 billion out of this privatization plan, of which US$16.5 billion will be in the form of public-private partnerships. We are looking to foster stronger partnership with the private sector on the management and financing of health infrastructure and services, as well as city transportation networks, school buildings, airport services, and water desalination and sewage treatment plants through these partnerships. The driving force is to create a better, more cost-effective, and efficient delivery, reducing material and energy usage for a better planet.”

Domestic Sukuk issuances are also driven by the objectives of the Kingdom’s Fiscal Balance Programme and Financial Sector Development Programme, the robust demand from local institutional investors, and the fact that foreign investors can also invest in local currency Sukuk through Tadawul (the Saudi Stock Exchange), which also has an active secondary trading in government Sukuk.

In the case of Sukuk, NDMC has confirmed that it’s Sukuk issuance strategy going forward centres around the Saudi Government SAR Sukuk Programme and foreign currency-denominated Sukuk issuances, as well as conventional bond offerings in the international market. This year’s plan will similarly be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer. All the Kingdom’s sovereign domestic Sukuk issuances come under the unlimited Saudi Arabian Government Saudi Riyal denominated Sukuk Issuance Programme established on 20 July 2017 by the Ministry and updated on 20 July 2020 “to issue and offer, at its discretion, Sukuk in multiple issuances to investors, pursuant to the Royal Decree approving the National Budget.” The Programme, structured and lead arranged by Alinma Bank, according to the MoF, also comes as part of the NDMC’s role in securing Saudi Arabia’s debt financing needs with the best financing costs and would contribute to the development of the Saudi Sukuk and Islamic Capital Markets.

Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market, because it has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives inter alia is to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.