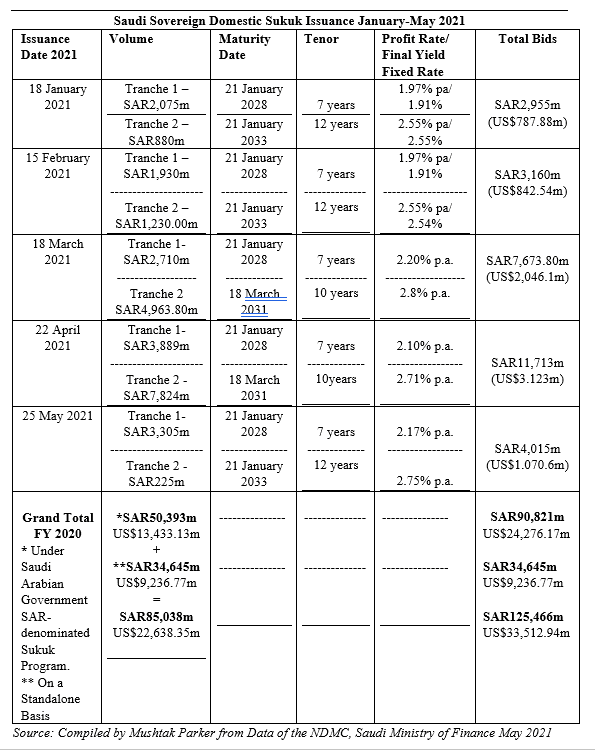

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) issued its fifth consecutive monthly issuance of Riyal-denominated sovereign Sukuk with a two-tranche SAR3.53 billion (US$941.26 million) offering in May 2021.

This follows the closing of a similar two-tranche SAR11,713 million (US$3,123 million) issuance in April 2021 – all under the Saudi Arabian Government SAR-denominated Sukuk Programme.

This means that in the first five months of 2021, the NDMC has raised the equivalent of SAR34,132.80 million (US$9,101.39 million) through five domestic sovereign Sukuk issuances. The SAR3.53 billion (US$941.26 million) offering in May 2021 comprised two tranches through two auctions held on 25 May 2021:

1. A first tranche of SAR3,305 million (US$881.27 million) with a 7-year tenor maturing on 21 January 2028 and priced at a final fixed profit rate/yield of 2.17% per annum, with total bids amounting to SAR3,305 million (US$881.27 million); and

2. A second tranche of SAR225 million (US$60 million) with a 12-year tenor maturing on 21 January 2033 and priced at a final fixed profit rate/yield of 2.75% per annum, with total bids amounting to SAR710 million (US$189.32 million).

The NDMC’s Domestic Sukuk Issuance Calendar for 2021 commits to a consecutive monthly Sukuk issuance strategy from January to December 2021. No other jurisdiction has committed to such a dedicated domestic Sukuk issuance regime in 2021. Moody’s Investors Services in October assigned (P)A1/Aaa.sa rating to the Government’s Saudi-riyal denominated Sukuk Programme for 2021.

Last year, according to data compiled by Mushtak Parker for this newsletter from MoF statistics, the NDMC issued under its Sukuk Issuance Programme domestic Sukuk totalling SAR50,393 million (US$13,433.13 million) with total bids amounting to SAR79,100 million (US$21,085.17 million).

In addition, the NDMC also raised SAR34,645 million (US$9,236.77 million) from a four-tranche standalone auction last July, bringing the total Saudi-riyal denominated Sukuk issued by the government in 2020 to SAR85,038 million (US$22,638.35 million), which is almost a 50% increase on the previous year. Saudi Sukuk issuance is expected to sustain its buoyancy in 2021, especially with the planned re-entry of the quasi-sovereign oil utility Saudi Aramco in the Sukuk market, which is a major boost for the Saudi and global Sukuk market this year.

In fact, Moody’s Investors Service at the time of writing assigned a (P)A1 rating to Saudi Aramco’s new Trust Certificate Issuance Programme. The Sukuk programme is established under SA Global Sukuk Limited, a special purpose company incorporated in the Cayman Islands.

However, the SA Global Sukuk Limited certificates have provisionally been assigned a negative outlook in line with the negative outlook on existing ratings of Saudi Aramco including its A1 long-term issuer rating, its Aaa.sa long-term issuer national scale rating, its (P)A1 Global Medium Term Note (GMTN) programme rating and A1 ratings on existing senior unsecured bond issuances.

The IMF also issued a statement following the conclusion of the annual Article IV Consultation for 2021 for Saudi Arabia by an IMF Staff Mission. The statement underscored the positive results of Saudi economic reforms, projected continuation in its economic recovery, and expected decline in the unemployment rate and inflation.

The IMF Article IV Consultation report projected real GDP growth at 2.1% this year and 4.8 % in 2022 (compared to a contraction of -4.1 % in 2020) and rebounded recovery of real non-oil GDP growth in the Second Half 2020. The statement also projected continued recovery in 2021. The real non-oil GDP growth recovery is projected to reach 3.9% in 2021 and 3.6% in 2022 compared to a decline of 2.3 % in 2020. In light of the production levels agreed by OPEC+, real oil GDP growth is projected to reach -0.5% in 2021 (compared to -6.7% in 2020), and 6.8 % in 2022 as the OPEC+ agreement is assumed to end as announced.

The statement commended the Saudi government’s swift and decisive containment measures to limit COVID-19 cases and fatalities, including fiscal rescue packages and financial sector and employment initiatives launched with the Saudi Central Bank (SAMA) that helped cushion the impact of the pandemic on individuals and the private sector. This coincided with the progress in implementing the vaccination campaign in recent months.

One encouraging IMF observation was the increasing participation of Saudi women in the local labour market. The Fund estimates that the participation rate of Saudi women in the total workforce increased by 13 points to exceed 33% during the past two years.

In terms of monetary policies, the financial sector, and exchange rates, the IMF Staff commended Saudi authorities for the well-capitalized and liquid financial sector, as well as SAMA’s efforts in regulating and supervising the financial sector, including private sector support programmes during the crisis, which have contributed in enhancing financial stability.

In addition, the Fund was impressed with the pace of equity and debt market reforms taken by the Saudi Capital Market Authority (CMA) and the NDMC, which contributed in increasing capital raising options for the government, companies and investment opportunities.

In the case of Sukuk, NDMC has confirmed that it’s Sukuk issuance strategy going forward centres around the Saudi Government SAR Sukuk Programme and foreign currency-denominated Sukuk issuances and conventional bond offerings in the international market. This year’s plan will similarly be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer. All the Kingdom’s sovereign domestic Sukuk issuances come under the unlimited Saudi Arabian Government Saudi Riyal denominated Sukuk Issuance Programme established on 20 July 2017 by the Ministry and updated on 20 July 2020 “to issue and offer, at its discretion, Sukuk in multiple issuances to investors, pursuant to the Royal Decree approving the National Budget.” The Programme, structured and lead arranged by Alinma Bank, according to the MoF, also comes as part of the NDMC’s role in securing Saudi Arabia’s debt financing needs with the best financing costs and would contribute to the development of the Saudi Sukuk and Islamic Capital Markets.

Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market, because it has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives inter alia is to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.