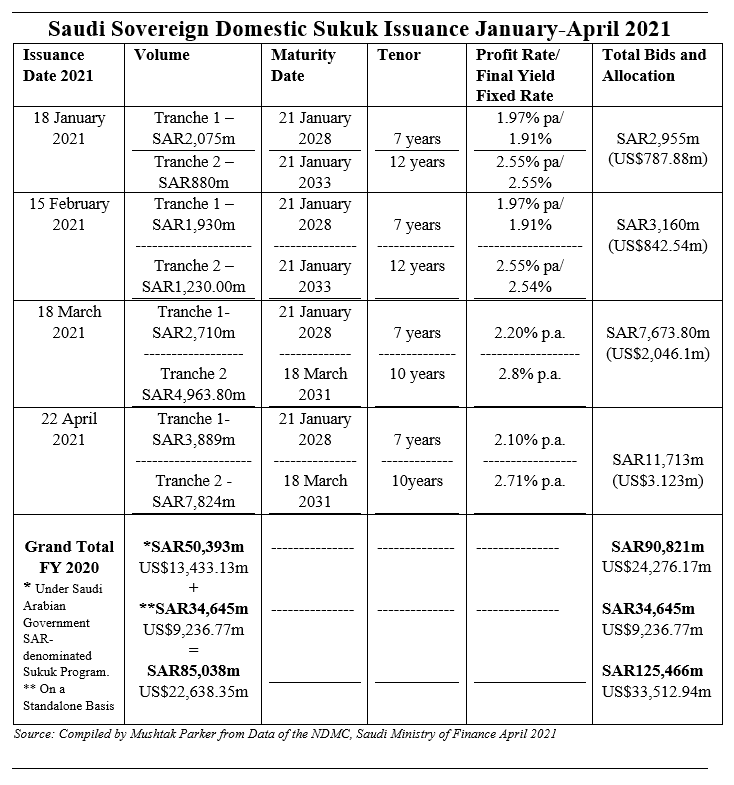

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) issued its fourth consecutive monthly issuance of Riyal-denominated sovereign Sukuk with a two-tranche SAR11,713 million (US$3,123 million) offering in April 2021.

This follows the closing of a similar two-tranche SAR7,673.80 million (US$2,046.11 million) offering in March 2021 – all under the Saudi Arabian Government SAR-denominated Sukuk Programme. This means that in the four months of 2021, the NDMC has raised the equivalent of SAR30,602.80 million (US$8,159.54 million) through four domestic sovereign Sukuk issuances.

The SAR11,713 million (US$3,123 million) offering in April comprised two tranches through two auctions held on 21 April 2021:

- A first tranche of SAR 3,889 million (US$1,037.98 million) with a 7-year tenor maturing on 21 January 2028 and priced at a final fixed profit rate/yield of 2.1% per annum, with total bids amounting to SAR 3,889 million (US$1,037.98 million); and

- A second tranche of SAR 7,824 million (US$2,086.09 million) with a 10-year tenor maturing on 18 March 2031 and priced at a final fixed profit rate/yield of 2.71% per annum, with total bids amounting to SAR 7,824 million (US$2,086.09 million).

The NDMC’s Domestic Sukuk Issuance Calendar for 2021 commits to a consecutive monthly Sukuk issuance strategy from January to December 2021. No other jurisdiction has committed to such a dedicated domestic Sukuk issuance regime in 2021. Moody’s Investors Services in October assigned (P)A1/Aaa.sa rating to the Government’s Saudi-riyal denominated Sukuk Programme for 2021.

Last year, according to data compiled by Mushtak Parker for this newsletter from MoF statistics, the NDMC issued under its Sukuk Issuance Programme domestic Sukuk totalling SAR50,393 million (US$13,433.13 million) with total bids amounting to SAR79,100 million (US$21,085.17 million). In addition, the NDMC also raised SAR34,645 million (US$9,236.77 million) from a four-tranche standalone auction last July, bringing the total Saudi-riyal denominated Sukuk issued by the government in 2020 to SAR85,038 million (US$22,638.35 million), which is almost a 50% increase on the previous year.

Saudi Sukuk issuance is expected to sustain is buoyancy in 2021. On the economic front there is better news despite the ongoing global coronavirus pandemic as mentioned in Saudi Arabia’s Quarterly Budget Performance Report Q1of FY21.

The Kingdom announced a significant narrowing of the government budget deficit to US$2 billion (0.3% of full-year GDP) in Q1/21 from US$29 billion in Q4/20 and US$9 billion in Q1/20.

“This decline in the government budget deficit during Q1/21 relative to Q4/2,” says Alexander Perjessy, Vice-president, Senior Analyst at Moody’s Investors Service, “is mostly due to higher oil prices and a large seasonal drop in spending. But there is also a material structural improvement in the non-oil fiscal balance when compared to Q1/20. This improvement reflects a significantly higher non-oil revenue (+39%), largely due to the tripling of the VAT rate last July, and the cut in capex (-47%), which is in line with this year’s approved budget. If oil prices average around US$60/barrel in 2021, we would expect Saudi Arabia’s full-year deficit to narrow below 5% of GDP from 11.2% of GDP in 2020, helping to reverse some of last year’s increase in the government’s Debt-to-GDP Ratio.”

Crown Prince Mohammed bin Salman, speaking on Saudi TV on 27 April reassured citizens that the “painful” threefold VAT increase is temporary and there are no plans to introduce income tax. The government increased VAT from 5% to 15% in July 2020 to boost state finances hit by lower oil prices. The current VAT rate will last one to five years and then go down to between 5% and 10%, he said.

The crown prince reiterated the Kingdom’s Vision 2030 with its core aim of diversifying the Kingdom’s economy away from reliance on oil, gas and petrochemicals. Saudi Arabia’s public finances, however, remain highly sensitive to fluctuations in the oil price as oil revenues continue to account for more than a half of total revenues, although this is down from an average of more than 70% in 2014-18. However, the Q1/21 fiscal performance figures also reveal a structural improvement stemming from the fiscal reforms and consolidation measures undertaken by the government in response to the coronavirus shock. As such, the net effect has been a reduction to vulnerability to oil price volatility.

In the case of the Kingdom, Sukuk issuance is based on a clear policy and not purely on budget and fiscal deficits. NDMC has confirmed that it’s Sukuk issuance strategy going forward centres around the Saudi Government SAR Sukuk Programme and foreign currency-denominated Sukuk issuances and conventional bond offerings in the international market. This year’s plan will similarly be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer. All the Kingdom’s sovereign domestic Sukuk issuances come under the unlimited Saudi Arabian Government Saudi Riyal denominated Sukuk Issuance Programme established on 20 July 2017 by the Ministry and updated on 20 July 2020 “to issue and offer, at its discretion, Sukuk in multiple issuances to investors, pursuant to the Royal Decree approving the National Budget.” The Programme, structured and lead arranged by Alinma Bank, according to the MoF, also comes as part of the NDMC’s role in securing Saudi Arabia’s debt financing needs with the best financing costs and would contribute to the development of the Saudi Sukuk and Islamic Capital Markets.

Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market, because it has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives inter alia is to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.